A Guide to Adopting ASC 842: Discount Rates and Fair Values

Through a virtual event, Riveron accounting and finance experts provided an overview of the complexities associated with the lease accounting standard ASC 842. For private companies with leased assets in the process of implementing these newer lease accounting standards, there are two primary technical application pain points: (1) considering the discount rates used to calculate lease liabilities and (2) determining fair value of certain leased assets. As private companies seek to adopt ASC 842 in a compliant and seamless manner, here are some key factors to keep in mind:

A private company has three options when choosing a lease discount rate: the rate implicit in the lease, the risk-free rate, or the company’s incremental borrowing rate (IBR).

When determining discount rates, lessors and lessees must first use the rate implicit in the lease, if available. From a practical standpoint, implicit rates are not explicitly stated in leases but can be inferred if certain details are presented in the lease agreement. Unfortunately, this often is not the case because the information necessary to calculate the implicit rate may disclose the lessor’s profit—and typically lessors are not willing to share this information.

A risk-free rate is the rate that investors would expect to earn from an investment that carries zero risk over a defined period of time. Typically, US-based companies use a US treasury rate for a comparable term. The pros of using a risk-free rate are that they are publicly available and easy to obtain, require no further investment, and are easy to audit. However, in most cases a risk-free rate will be much lower than the IBR. Companies with large lease portfolios containing longer-term leases may discover that using a lower risk-free rate can have a material impact of increasing the size of their lease liabilities. Furthermore, any companies that go public or are acquired by a public company will be forced to transition to the IBR.

Nearly all lessee contracts will use the IBR. The Financial Accounting Standards Board (FASB) defines the IBR as “the rate of interest that a lessee would have to pay to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment.”

In other words, the IBR is the interest rate that a company would pay to borrow funds equal to the lease payments over the lease term, assuming that the loan is also collateralized by the underlying assets.

IBRs are driven by company-specific inputs, such as a specific debt structure credit rating, which results in a more accurate rate for discounting leases. The IBR is typically higher than the risk-free rate, which means IBRs usually result in a lower lease liability. Lastly, using the IBR requires less re-work for companies when planning to go public, or if an organization is acquired by a public company.

The main challenge with using IBRs is that most private companies lack robust treasury departments, which inhibits access to certain inputs that are necessary in calculating the IBR, such as credit ratings yield curves, debt, and liquidity ratios. These companies will need to procure third-party expertise and support, which can be time consuming and costly. Additionally, IBRs must be updated quarterly, or at least annually, depending on a company’s reporting requirements. Each time a company engages with external experts or undergoes complex accounting processes, it is an added expense.

In deciding which lease discount rate to use, companies should ask three questions:

- What is the impact of using the risk-free rate? Related considerations include whether the company plans to go public within the next few years; whether the lease portfolio is large enough that a low discount rate will have a large impact on the balance sheet; and whether covenants exist that may be impacted by a large lease liability.

- What is the debt profile? Here, it is important to consider if the company has debt instruments with terms and origination dates materially close to the largest leases. It is also important to examine if the company has collateralized debt.

- How will the IBR be calculated—using a synthetic debt rating to develop a yield curve, or by analyzing similar, publicly available debt information? Nuances that shape the approach include whether the company has a treasury department; in addition, it helps if the company has a license or other access to financial market terminals and data tools, and, if not, the company might seek to leverage a relationship with a third-party valuation services provider if calculations can be achieved in a cost-effective manner.

ASC 842 enables companies to avoid reassessment of existing lease classifications.

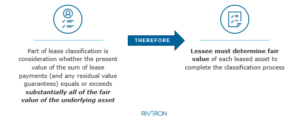

Upon the adoption of ASC 842, companies may elect to roll forward previous lease classifications. Electing to roll forward previous lease classifications alleviates the burden of assessing the fair value of each leased asset. However, if leases have not been classified correctly under ASC 840, the prior lease accounting standard, the company will need to change its classification under ASC 842. As part of the adoption, auditors will often ask companies to provide documentation to support lease classification under ASC 840.

Figure 1: Determining fair market value

Many companies struggle with determining the fair market value of their assets. Valuing equipment and fleet tends to be easy, as the lessor may include the price of these goods in the contract, or this information may be readily available from a similar vendor or market source. Valuing real estate assets tend to be more difficult given the multiple factors contributing to the fair value. Furthermore, lessees typically rent fractions of spaces, and calculating the value of a partial building is a challenge.

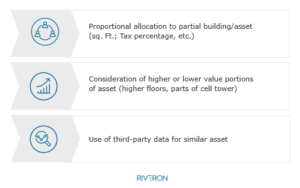

ASC 842 states that “when it is not practicable for an entity to determine the fair value of an underlying asset, lease classification can be determined without consideration of the present value of lease payments criteria.” However, auditors believe this scenario is unlikely for most organizations. Here are some examples of approaches to real estate valuations that companies can use to obtain appropriate valuations.

Figure 2: Valuation approaches

While compliance with ASC 842 can be time-consuming and unexpectedly complex, identification and solutioning of complex issues (like the identification of discount rates and the determination of fair value of assets) at the outset of the project can help avoid timely delays and rework – especially with regards to an audit of a private company’s ASC 842 adoption process. Additionally, companies can use the process for other tangible benefits such as gathering better data for lease-versus-buy decisions and downstream financial metrics.

For more insights that can assist in the adoption of the new lease standard, ASC 842, watch the webinar replay.