Decision Frameworks and Technology Considerations for Adopting ASC 842

A virtual event featured Riveron’s Michael Cahill, Craig Rowlings, and Amelia Lagowski, along with Trullion’s Isaac Heller, who provided a technology-related perspective. The experts discussed several considerations for private companies adopting the new accounting standard for leases, ASC 842. Frameworks and checklists can help guide the process because the scope of lease agreements (known and embedded within other agreements) can vary greatly from company to company, and each company can have a markedly different desired approach for adopting accounting standards. Technology can support these efforts in several ways: enabling automation that supports compliance efforts of accounting and finance teams, providing additional value by modernizing a company’s finance function, and strengthening cross-functional partnerships.

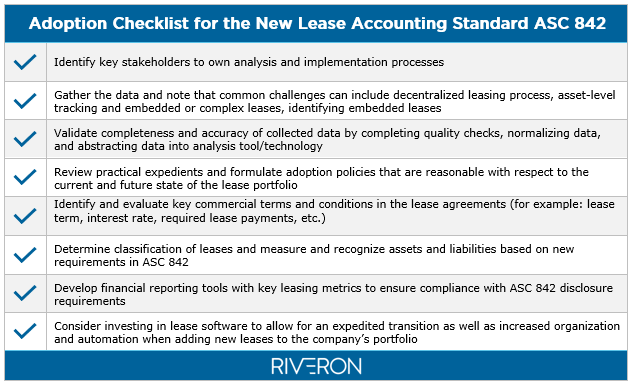

Here are key considerations for private companies adopting the new lease accounting standard:

Private companies need to make several decisions to adopt lease accounting standards in a streamlined manner

Although criteria for the new lease accounting standard may be similar to the former standard (ASC 840), the new standard is complex, and implementations can be time consuming. Companies need to take a proactive approach to ensure that any documentation makes sense when audit season comes around.

Note that it can be especially complex for companies to identify whether embedded leases exist. Often contracts are not labeled “lease” even though an agreement might be deemed as such from regulatory point of view. One key qualifier is whether a supplier has the right to substitute a part (for example, coffee machines are a common piece of equipment that qualify as a lease; if the supplier can substitute the equipment, then it is considered a lease).

When adopting the new standard, to make decisions about the use of practical expedients, and how to properly document justifications for lease classifications, the following checklist provides key considerations:

To adopt ASC 842, companies should use an internal controls framework and forward-thinking approach supported by technology

There are many variables to adopting new accounting standards, and companies should start the process with auditors in mind. To drive success, a company must understand whether the portfolio is complete to support the transition and necessary documentation (companies need to know how to look for embedded leases, and there are many approaches to doing so). Also, to support internal and external reporting, a company must ensure its data is complete and accurate. Often, companies conduct highly manual efforts to gather complete information, perhaps contained in dozens of spreadsheets, and it can be helpful to streamline and centralize the information as much as possible. Next, the company should evaluate whether its intended approach for adopting a new accounting standard will help the company improve in the long run. Finally, the company should assess whether the right technology is in place to support its processes, and the following framework can serve as a guide:

1) Ensure a complete portfolio of lease accounting information

Begin with a vendor assessment; clearly document the embedded lease assessment approach and results. Engage the auditor up front and early in the process to discuss (and refine if necessary) the feasibility of the approach. Completeness of the portfolio is often the first and highest priority for audit review.

2) Prioritize data abstraction and normalization

Develop a cross-functional team to work on abstraction, and note that this task can be complex, so assigning ASC 842 adoption efforts to an entry-level employee or temporary staff probably will not sufficiently support this effort.

3) Consider how technology will support business outcomes

Sufficient data quality is necessary even when using a highly sophisticated technology solution to enhance accounting and finance processes. Also, the desired business processes should drive the technology selection and implementation decisions because new technologies will not fix poor processes. Further, when implementing new technology, companies should also consider the internal control implications of using the new software before going live.

Technology can improve adoption of new accounting standards and drive more value within organizations. Beyond compliance, teams should seek ways that technology can offer their organization centralized expense management capabilities or other forms of incremental value. Some key current trends shaping the financial technology (fintech) industry: (1) within organizations, the flow of financial information can be very siloed; (2) new accounting standards create an additional layer of complexity, which sometimes create more risk related to manual or highly inefficient processes; (3) automation technologies (sometimes called “AI”) can enable more accuracy through image recognition (to quickly read and extract data from invoices), natural language processing, and other useful applications.

When evaluating whether to adopt ASC 842-related processes manually (using Excel), often the “magic” number is roughly ten leases before this becomes too inefficient. Beyond that point, private companies can benefit from using automation technology. Fintech solutions such as Trullion use software and data tagging capabilities to provide suggestions to drive judgement and guide other decision points, while also providing real-time data that can be helpful in managing data and demonstration information to auditors when necessary (such as tagging a clause within a lease and later retrieving tagged information to review with auditors).

4) Drive success through teamwork and collaboration

Using technology to adopt any new accounting standard is an effort that extends beyond the CFO. Since leasing involves multiple departments within an organization, companies should appoint cross-functional teams early, and teams should include all affected departments. To ensure success of any initiative, roles must be assigned for the leader, change agent, and subject matter experts.

5) Think beyond implementation

Consider how the company wants things to work post implementation (this should factor in any possible mergers and acquisitions likely to occur in the near term). Let the software do the heavy lifting for repetitive tasks, and—since any technology initiative can be disruptive—build a change management program into the process.

For additional details, watch the webinar replay.