How Accounting & Finance Can Soar: Rebuilding Your Engine While Flying

For accounting and finance leaders, strategically enhancing operations to support rapid growth is like rebuilding a plane during flight. Our downloadable self-assessment guides your function to build momentum and enhance accuracy, visibility, and analytics while tackling day-to-day operations.

For mid-to-large private companies, rapid growth is exhilarating. But, for professionals working within the finance and accounting functions, growth can often feel like you’re rebuilding a plane while it’s still mid-flight. Stopping for a complete overhaul of your finance function simply isn’t an option; your internal stakeholders, customers, and investors won’t wait. Yet, continued ascent demands upgrades. In these times of transition and growth, it’s not just about operating the accounting and finance function; it’s about fundamentally transforming the underlying processes, work practices, and supporting technologies.

Rapid growth follows an inevitable flight path—frequently outpacing existing accounting and finance infrastructure. This can lead to a reliance on manual processes, disaggregated data, and a frustrating lack of real-time insights, which hinders profitable growth, decision-making, and potentially jeopardizes future value creation. Growing private companies face a unique challenge: modernizing critical finance and accounting operations without missing a beat.

Why a "Stop and Rebuild" Approach is a Non-Starter

The idea of halting operations to fix your finance function might seem appealing in theory, but in practice, it’s often detrimental due to:

Market Imperatives: Competitive pressures, customer demands, and investor expectations simply don’t pause for internal finance overhauls.

Growth Momentum: Halting growth to “fix” finance can lead to a loss of market share and missed opportunities that are difficult to recover.

Operational Disruption: A large, unphased overhaul risks significant operational disruption across the entire business, leading to team burnout and resistance.

Discover how a strategic, phased approach can enhance accuracy, visibility, and analytical capabilities while maintaining crucial business momentum, turning complexity into clarity.

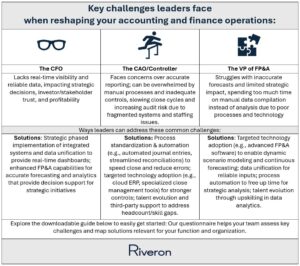

The “Flying Plane” Challenges for Private Company Finance and Accounting Leaders

Growth puts immense pressure on your finance team, often surfacing a range of common operational challenges. Here’s what that often looks like for key leaders:

For the Chief Financial Officer (CFO):

- Strategic Blind Spots: You need real-time, consolidated financial visibility to make agile decisions and allocate capital effectively. Without it, you’re flying in the dark, often contending with prolonged close timelines and delayed reporting.

- For example, one CFO recently enlisted our team to advise on tech pain points, swiftly shifting focus to strategic ways to improve working capital utilization, optimize accounting and finance processes, and directly impact cash flow velocity. This order-to-cash transformation automated most order-to-invoice processes and reduced half of the manual invoice-to-cash efforts, accelerating cash realization and improving liquidity for strategic investments. The resulting 99% billing accuracy and greater than 90% overall master data and reporting accuracy provided reliable, real-time insights crucial for the CFO to confidently make key decisions and allocate capital. Similarly, we’ve served as a catalyst for several other CFOs, strategically improving the dynamic between Finance and Sales by elevating processes and markedly reducing the number of days sales outstanding (DSO).

- Unreliable Reporting: Accurately projecting future needs or demonstrating financial health to potential investors and lenders becomes a significant hurdle when data is inconsistent or unreliable, which makes it more difficult for CFOs to articulate an accurate financial picture.

- In our recent work with a global network management services provider, the team’s manual, spreadsheet-based approach hindered the CFO’s ability to confidently project cash flow and present an accurate financial picture to key stakeholders and investors. By helping the company select and implement OneStream as its global Corporate Performance Management (CPM) system, we empowered the CFO with centralized, on-demand reporting , significantly reducing close times and forecasting cycles. The solution also streamlined data integration and workflow management from NetSuite. This elevated approach to reporting provided the CFO and leadership team with the strategic clarity and reliable data needed for confident decision-making and optimizing capital allocation.

For the Chief Accounting Officer (CAO) / Controller:

- Manual Overload: Burdensome, error-prone manual processes—think endless reconciliations, journal entries, and reporting—slow down your month-end close and create unnecessary stress. Savvy CAOs and controllers are seeking ways to reduce their teams’ over-reliance on manual processes and better manage large or aged unreconciled balances.

- Recently, we partnered with a services company to transform their record-to-report process and optimize their close. Our efforts led to the automation of over 50 manual journal entries and a projected 30% reduction in monthly manual journal entries. Our targeted automation and process enhancement also significantly improved the adoption of BlackLine for account reconciliations and close management. These improvements ultimately achieved FTE savings equivalent to 10% of their accounting organization.

- Control Risks & Inaccuracies: Fragmented systems and weak controls significantly increase the risk of errors, non-compliance, and a need to deal with audit deficiencies. These issues can be especially prevalent when dealing with decentralized, disparate processes and teams or facing employee turnover and inadequate headcount.

- A common scenario we’ve helped companies address is reflected in our work with a rapidly growing PE-backed distribution firm. They faced significant audit risk due to unreconciled accounts, a large unapplied cash balance, and improper project accounting. We dove deep, identified and corrected root-cause errors across cash application and project accounting—reconciling balances, restating project financials, and implementing stronger, scalable procedures and technology enhancements. The result was audit-ready financials and processes built to support ongoing growth.

For the Vice President of Financial Planning & Analysis (VP of FP&A):

- Forecasting Frustration: Producing timely, accurate, and granular forecasts is nearly impossible with poor data quality. In addition, the need for constant, manual aggregation is often exacerbated by inefficient or under-utilized technology.

- Many of our clients are considering how their visualization capabilities can be elevated and how their related data warehouse needs can be solved. VUE by Riveron, an automated reporting solution, has enabled several organizations to implement dashboards in rapid timeframes and use their existing data in a centralized and easily maintained way. By having more real-time access to a single source of truth, activities like forecasting—which require a firm grounding in actuals, booked revenue, and historical trends—become far more efficient and effective.

- Limited Strategic Impact: You’re spending too much time collecting data and not enough analyzing it or providing proactive insights and robust scenario modeling.

- In serving one of our private equity clients, a portfolio company was relying solely on spreadsheets for budgeting, limiting the ability to model scenarios quickly. We introduced a new FP&A tool that allowed them to run dynamic ‘what-if’ analyses in minutes, directly informing strategic growth initiatives.

Common symptoms across the board include heavy reliance on spreadsheets, disparate systems that don’t talk to each other, a lack of integrated data, and an inability to scale processes as the company grows.

The Toolkit for “In-Flight” Finance Modernization

So, if you can’t land the plane, how do you rebuild it? It requires a strategic phased implementation, prioritizing critical areas for incremental, manageable changes, ultimately simplifying the complexity of transformation.

Here are the core pillars of in-flight modernization:

- Data Unification & Governance: Establish a single source of truth for financial and operational data. Implement robust data governance policies. This gives the CAO/Controller greater accuracy, the VP of FP&A better insights, and the CFO the strategic visibility needed.

- A common challenge we see is siloed data. For one of our clients, integrating data from their CRM, ERP, and payment systems into a single data warehouse provided their finance team with a holistic view, vastly improving their sales forecasting accuracy.

- Process Standardization & Automation: Automate repetitive accounting tasks and standardize financial processes across departments and entities. This frees up the CAO/Controller’s team for more strategic work and helps the CFO control costs.

- As mentioned above, our work with a services company targeted automation and process enhancements, which can significantly streamline operations. In this case, it led to a projected 30% reduction in manual journal entries and substantial FTE savings.

- Targeted Technology Adoption: Strategically implement cloud-based ERP systems, FP&A software, data transformation tools, and intelligent accounting automation platforms. Crucially, this doesn’t always mean a massive, expensive overhaul. There are numerous “right-sized” solutions available that integrate with existing ERPs and are perfectly suited for a company’s specific size, budget, and maturity stage. These targeted implementations can still powerfully address pain points like manual work, error prevention, and the lack of centralized data, ensuring technology is an enabler, not a burden. This enhances the VP of FP&A’s analytical capabilities, provides the CFO with scalability, and strengthens the CAO/Controller’s controls.

- Enhanced Finance Analytics & Insights: Move beyond traditional budgeting to continuous forecasting, driver-based modeling, and robust scenario analysis. Leveraging one source of truth across various financial and operational KPIs, FP&A teams can move with speed and establish a quicker path to insights. This directly empowers the VP of FP&A and provides immense benefits to the CFO and other operational stakeholders.

- Talent Evolution: Upskill existing finance teams and strategically add new capabilities, such as data analytics specialists and system experts. Consider targeted, short-term investments in third parties to create more bandwidth and bring finance transformation capabilities to train your teams and strengthen the CFO’s overall team capability.

- We helped a rapidly scaling services firm assess their finance team’s current capabilities against future needs, then developed a targeted training program for their existing staff on new software, reducing their need to hire externally by 30% in the short term.

- In times of significant growth or transition, such as preparing for a SPAC or IPO, companies often experience turnover in critical finance roles. This can create immediate operational gaps and jeopardize readiness for taking a company public. During these times of transition, Riveron frequently steps in to fill key roles such as interim Controllership, Accounting Manager, or even full project teams. Our interim leaders not only ensure day-to-day operations run smoothly but also actively enhance the organization’s capital markets journey and elevate accounting and finance processes. This ensures that when permanent employees take over, the organization is ultimately better off—transformed, efficient, and ready for sustained success. Read a related success story here: Advancing a Tech Company’s SPAC Journey and SOX Framework While Filling Key Accounting Roles

- Continuous Improvement Loop: Embrace agile methodologies for ongoing optimization and adaptation. Ensure robust project and change management across initiatives to maintain momentum while ensuring day-to-day milestones are achieved. Finance transformation isn’t a one-time project; it’s a continuous journey.

The Landing Zone: What Success Looks Like While Soaring

Successfully rebuilding your finance function mid-flight yields significant benefits for every key player:

- For the Chief Financial Officer (CFO): You’ll have clear, real-time dashboards for strategic decision-making, improved cash flow predictability, and an enhanced ability to articulate financial health to investors and boards.

- For the Chief Accounting Officer (CAO) / Controller: Expect faster, more accurate month-end close cycles, reduced audit effort and risk, and a stronger internal controls and compliance posture, as demonstrated by companies achieving audit-ready financials through root-cause error correction and process improvement.

- For the Vice President of Financial Planning & Analysis (VP of FP&A): You’ll gain reliable, granular forecasts, dynamic scenario modeling capabilities, and the ability to provide proactive, data-driven recommendations that truly impact the business.

Charting Your Course: Key Questions for Your Finance Team

To rebuild your accounting and finance operations while still “flying the plane,” it’s essential to ask the right questions. These high-level inquiries can help guide your organization toward strategic improvements without disrupting day-to-day momentum:

- Where are our most significant manual bottlenecks in financial reporting and close processes?

- Which current systems are preventing us from achieving real-time data visibility and integrated insights?

- Are our current FP&A capabilities truly supporting strategic decision-making, or are we primarily focused on historical reporting?

- How can we empower our existing finance team with new skills and technologies to adapt to evolving demands?

- What are the top 1-2 urgent pain points that, if addressed incrementally, would yield the most significant impact on accuracy and efficiency?

Download the Excel & PDF Guide

Elevate Accounting & Finance with an In-Depth Guide

For a more comprehensive assessment and actionable steps, download our Accounting & Finance Transformation Checklist for Growing Private Companies. This guide provides a detailed framework to evaluate your current state and prioritize strategic improvements while maintaining business continuity.

Charting a Course for Sustainable Growth

“Rebuilding the plane while flying it” isn’t just a metaphor; it’s a necessary and achievable strategy for private companies to unlock their full growth potential. Finance functions that can adapt and improve without missing a beat gain a significant competitive advantage in today’s fast-paced market.

While we’ve provided a self-assessment guide and key considerations to get you started, navigating this complex and critical journey doesn’t have to be a solo flight. Riveron can serve as your trusted co-pilot, listening, diagnosing the problem, defining the solution, and creating an action plan. We bring clarity to complexity, helping you identify and implement reasonable and sustainable process changes. We execute with urgency, ensuring we leave your data, processes, and team better than how we found them.