Framing It Up: Everything You Need to Know About ESG Framework Adoption Trends in 2022 and Beyond

When it comes to voluntary ESG disclosures, 2022 was a record year. Companies across the S&P 400, 500, and 600 stepped up transparency and reporting by publishing corporate sustainability reports (CSRs) in droves and taking the often resource-intensive steps to align with external frameworks and standards. Several frameworks reported unprecedented adoption rates last year.

While the major uptick in transparency is driven in part by stakeholder expectations for greater visibility into ESG metrics, it’s also a sign of increased ESG maturity among leading companies, particularly the S&P 500, (most of which were disclosing some form of detailed ESG information as of 2021.)

As a result, the last several years have marked rapid growth in the integration of ESG into organizations’ strategy and goal setting. As companies aim to share their progress, they are recognizing that the reporting on an effective ESG strategy includes the adoption of voluntary ESG reporting frameworks.

The Five Most Adopted Frameworks

So, which ESG reporting frameworks are companies adopting? The answer largely depends on the metrics material to the company’s industry and operations as well as external forces such as customer data requests or investor expectations.

To learn more and benchmark the trends, Riveron tracked alignment with the following five leading frameworks/standards among the S&P 400, 500, and 600 in 2022:

- Sustainability Accounting Standards Board (SASB). SASB has long been a starter framework for companies voluntarily disclosing ESG data. It is relatively easy to adopt due to its limited scope and industry-specific consideration of financially material topics. SASB also offers flexibility in how companies report the requested information.

- CDP. The Climate Disclosure Project is a framework that is responded to by filling out a complex questionnaire on the group’s website. CDP is often completed to comply with a major customer’s request. (This request comes along with the potential for public embarrassment when a failing grade is reported on CDP’s own website for companies that choose not to comply.) As the appetite for detailed environmental data disclosures increases under the expectation of mandatory disclosure, customers like Microsoft are increasingly asking their suppliers to fill out the CDP questionnaire. In 2022, a record number of organizations disclosed through CDP.

- Task Force on Climate-related Financial Disclosures (TCFD). TCFD disclosures continue to gain popularity as organizations prepare to comply with the forthcoming SEC rule which largely mirrors this framework on issues related to climate-related financial disclosures. BlackRock’s continued desire for climate risk reporting aligned with the framework is another major impetus for TCFD adoption.

- The Global Reporting Initiative (GRI). GRI created the first sustainability reporting framework in the late 1990s and measures the impacts a company has on the environment, society, and the economy. Ratings are based on a voluntary issuer questionnaire covering topics the organization deems to be most material.

- UN Sustainable Development Goals (SDGs). The UN Sustainable Development Goals (SDGs) consist of 17 goals that aim to be achieved by 2030 and are meant to mobilize countries and organizations to tackle climate change, end poverty, and reduce inequality.

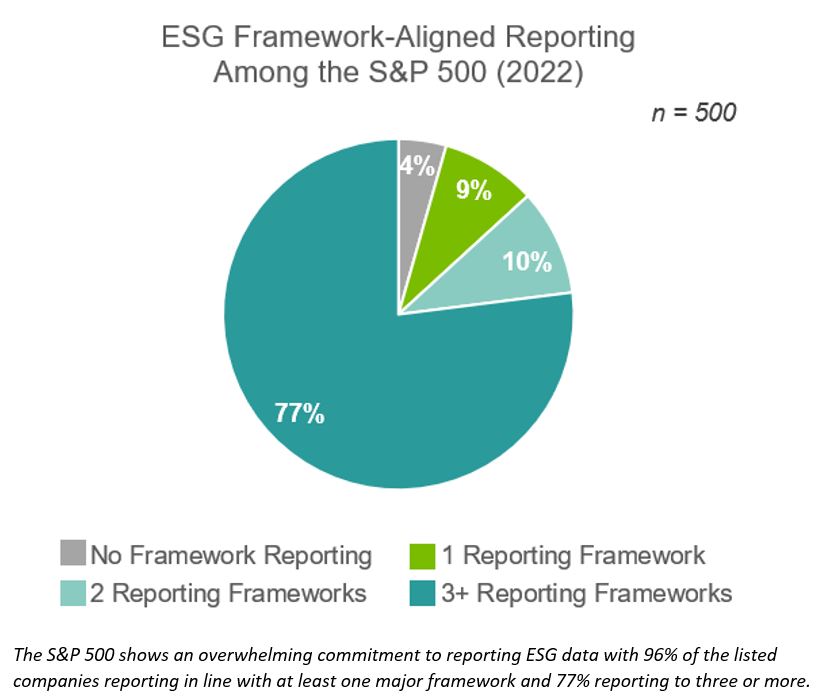

The S&P 500 Are Clear ESG Leaders Reporting Across all Five Frameworks

Our benchmarking work revealed significant differences in how companies of different sizes use the five frameworks. Among the S&P 500, framework adoption is nearly universal. The organizations demonstrated an overwhelming commitment to reporting ESG data in 2022 with 96% of the listed companies reporting in line with at least one of the five major frameworks. An even better measure of the value the S&P 500 places on ESG disclosure is the proportion of companies reporting to multiple frameworks: more than three-quarters of this group aligns with three or more of the top five standards.

S&P 500 companies acknowledge the value of reporting to several frameworks due to their differing considerations of material topic areas and data requested. Companies frequently report to multiple frameworks to satisfy various stakeholder groups soliciting information. For example, a company may respond to a customer request to fill out the CDP questionnaire and publish a TCFD-aligned report to satisfy investor appetite for climate risk disclosures.

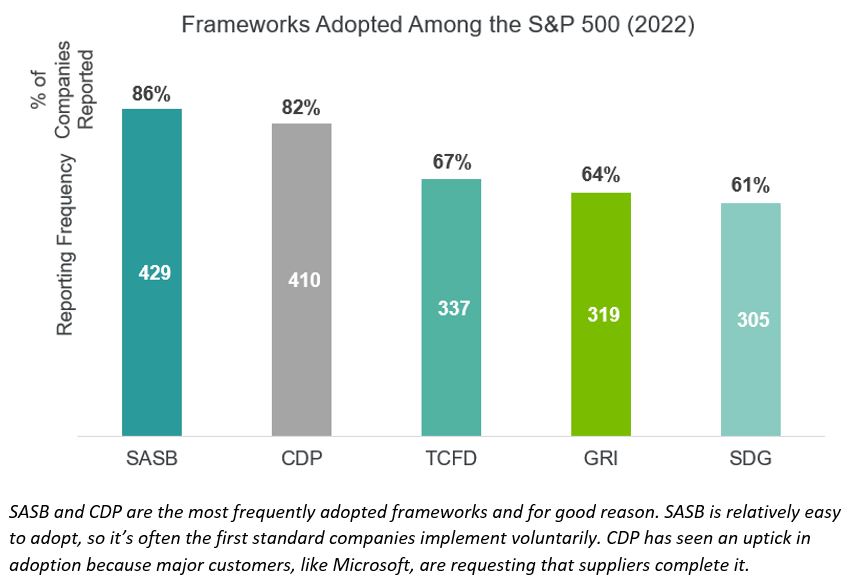

As a result, all five frameworks are in use by a majority of the S&P 500. But SASB is the most popular with 86% of organizations reporting aligned with SASB in 2022. CDP, which this group often pairs with SASB, is a close second with 82% of companies submitting responses to the CDP questionnaire last year, often in response to a customer’s request.

TCFD came in third place with 67% of the S&P 500 publishing TCFD reports or indices. While somewhat less popular than the other frameworks, both GRI and the SDGs also had high levels of adoption among this group at 64% and 61% respectively.

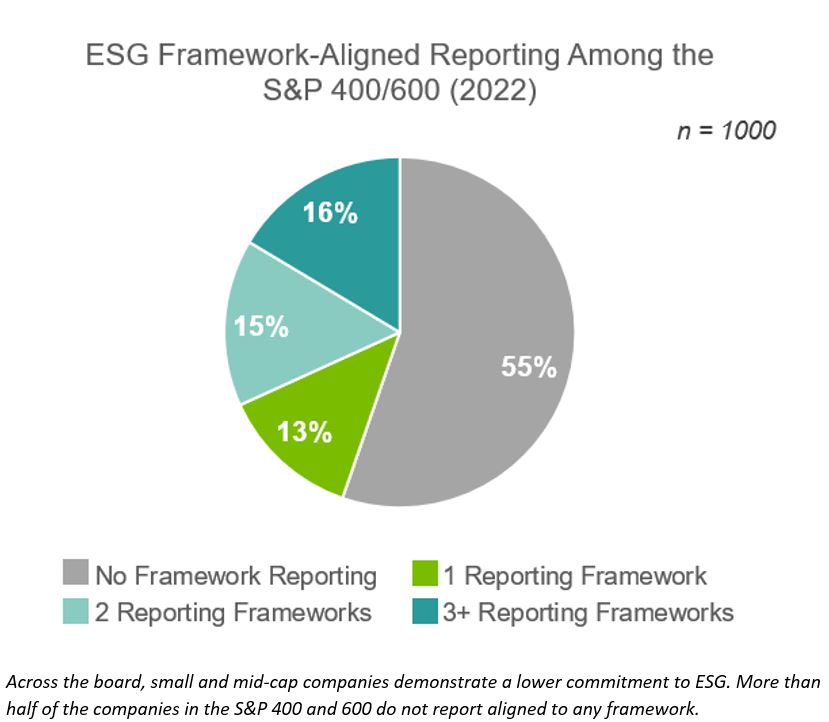

The S&P 400 & 600 Are Picking and Choosing How to Disclose

In contrast to the virtually unanimous adoption of ESG framework reporting by the S&P 500, a look at the S&P 400 (Mid Cap) and 600 (Small Cap) tells a different story. More than half of the companies in these indices, 55%, are not reporting in line with any of the five examined frameworks. That doesn’t mean they aren’t talking about ESG at all. Some companies publish ESG reporting not associated with a given standard, such as a sustainability webpage or brief narrative report. However, best practice ESG reporting generally includes reporting to at least one framework to allow for comparability of data.

Furthermore, the 45% that do report to a standard are nearly as likely to report aligned with only one framework as they are to report to two, three, or more. This represents another significant deviation from the S&P 500, where 77% of companies report to three or more frameworks.

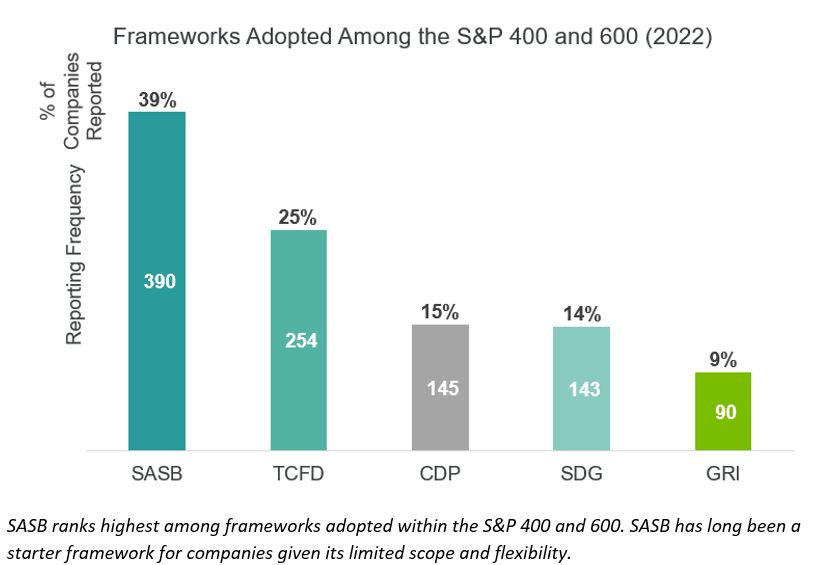

Small and mid-cap companies often have limited ESG resources and must be more selective in their framework alignment efforts. SASB is the most adopted framework among this group, just as it is with the S&P 500. The difference is, for many of 39% of the S&P 400/600 publishing a SASB-aligned report, SASB may be the only framework used. This makes sense given SASB’s relatively easy adoption and reputation as a starter framework.

TCFD is the second most popular framework for smaller companies with 25% of companies reporting against TCFD guidelines. This is likely a product of external pressures stemming from institutional investor focus on TCFD and proactive planning for SEC alignment.

CDP, SDGs, and GRI came in third, fourth, and fifth with only 15%, 14%, and 9% of companies adopting the frameworks, respectively.

The most notable difference between the S&P 500 vs. the 400/600 is the low occurrence of CDP reporting. Just 145 companies of the 1,000 listed in the S&P 400/600 filled out the CDP questionnaire in 2022, roughly 15% compared to 82% of the S&P 500. CDP is a data-heavy framework, requiring a large resource commitment on behalf of the filing company. It is likely that small and mid-cap companies, when deciding which single framework to align with, focus instead on the frameworks with financial emphasis, like SASB and TCFD. These provide the most value in exchange for limited resources, allowing small and mid-cap companies to provide the most financially material and investor desired ESG information.

Even with Adoption on the Rise, the ESG Landscape Continues to Evolve

The world of ESG reporting is still rapidly evolving. Numerous frameworks have gained traction in the last several years, requiring companies to gather an ever-wider array of ESG and financial metrics. While more information is generally better from an investor perspective, one common complaint stemming from the popularity of so many different frameworks is the lack of a common standard to allow for the comparability of data. Companies often complain of “framework fatigue” due to the numerous requests for ESG data from interested parties.

The industry is taking steps to address this concern. The IFRS Foundation, through the Integrated Sustainability Standards Board (ISSB), has released proposed sustainability and climate reporting standards that aim to establish baseline global reporting standards. The proposed standards are built on the existing SASB guidelines for financial materiality in each industry and integrate the TCFD framework, as well as recommendations from the Climate Disclosure Standards Board and the World Economic Forum. In addition, CDP recently announced its intent to integrate the ISSB climate-related disclosure standard into its platform.

Though TCFD and CDP are not going away – indeed, the desire for transparent reporting on climate-related metrics and risks is only increasing – the distribution of framework alignment for companies across the market may continue to shift as frameworks consolidate or integrate each other’s recommendations.

Get the Most from Your Reporting Efforts

Deciding on and successfully implementing the right ESG framework for your ESG strategy can be a challenge, especially if limited resources will only allow for alignment with one or two standards. If you have questions, need some direction, or could use a little help with the reporting process itself, give us a call. Our experts can help you interpret the framework reporting trends in the context of your unique business and make the choices that make the most sense for you.