Pillar Two Advisory

OECD Pillar Two: Ensuring Global Minimum Tax Compliance

A Cross-Functional Effort

In the current dynamic landscape, the Office of the CFO is gearing up to meet the cross-functional challenges posed by the global minimum tax requirements outlined in OECD Pillar Two. The transformative guidelines impact entities on a multinational scale, starting in early 2024. Pillar Two compels both public and private companies to coordinate efforts and align accounting and financial expertise that extends beyond just the corporate tax department, including compiling financial data that is sufficiently detailed by jurisdiction.

What is OECD Pillar Two?

Complying with OECD Pillar Two is a global initiative that reaches beyond the corporate tax department. Proactive measures become paramount for the Office of the CFO to navigate the intricate landscape of financial data and reporting requirements.

What companies need to comply with OECD Pillar Two?

Entities that will need to follow Pillar Two guidance include:

Revenue threshold: If your company’s GAAP/IFRS consolidated revenue exceeds 750 million euros in any two of the past four years,

International operations: And if your company operates in more than one country.

Corporate accounting, finance, and tax professionals will need to work in collaboration to understand and comply with the OECD global minimum tax requirements and anticipate auditor expectations.

Proactive Measures for CFOs and Controllers – What you can be doing now

Riveron can help anticipate financial reporting requirements and auditor expectations in a timely and comprehensive manner.

Establish a cross-functional Pillar Two Approach:

Public Company

Pillar Two compliance involves

Quarterly Tax Expense Calculation:

Calculate and record quarterly tax expense and relevant disclosures starting in the first quarter of 2024.

Standalone Financial Data:

Accurately capture standalone financial data and understand tax liability across all relevant jurisdictions.

Private Company

Pillar Two compliance requires

Estimated Annual Tax Liability:

Determine estimated annual tax liability in Q1 2024 for accurate tax payments and to avoid underpayment penalties.

Comply with Annual Reporting Requirements:

Assess the need for standalone financial reporting requirements

Stay ahead, stay compliant

Compliance involves more than the traditional corporate tax considerations. Companies falling within the scope of OECD Pillar Two need to create separate legal entity trial balances by January 2024 for every jurisdiction with less than a 15% effective tax rate and report their global top-up tax on their Q1 2024 financial statements. Riveron can help get you get up to speed to become compliant and help you stay ahead of the requirements.

Download Pillar Two GuideNo Executive Leaders or Managing Directors matched your search.

Related Insights

Insights

Accounting and Financial Reporting Insights from the 2024 AICPA & CIMA Conference

From evolving standards to emerging technologies, the latest AICPA conference illuminated several themes that will shape priorities for 2025.

Insights

Trump’s Return Equals Major Tax Changes for Businesses

Tax-related policies in 2025 and beyond are likely to have a marked impact on businesses, especially related to tariffs, provisions in the Tax Cuts and Job Act (TCJA), and international tax matters.

Insights

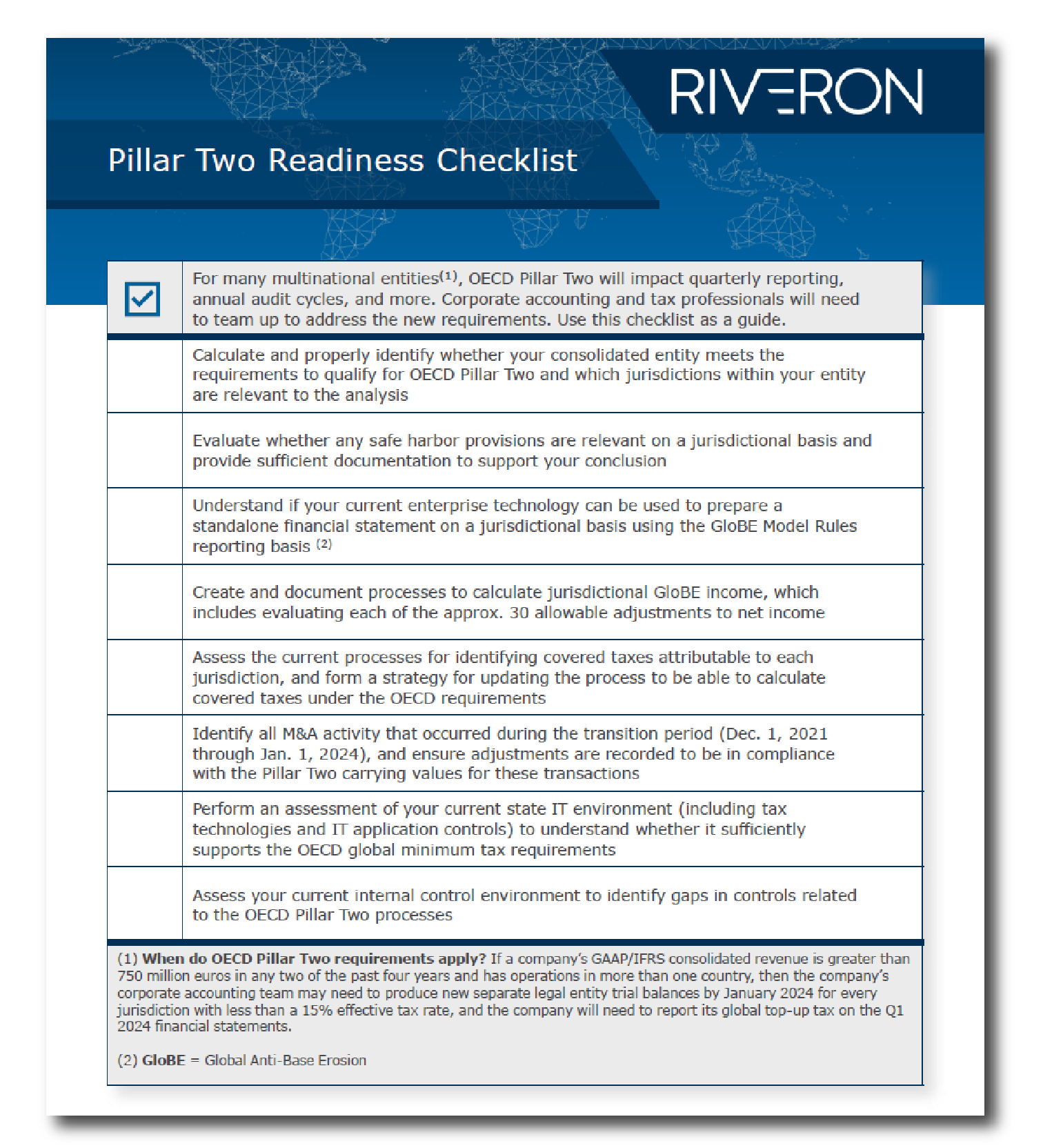

Corporate Accounting Teams: Pillar Two Requires a New Set of Books – Are You Ready?

Pillar Two is a cross-functional effort, and here’s a readiness checklist. Corporate accounting and financial reporting teams must work in collaboration to comply with the OECD global minimum tax requirements and anticipate auditor expectations.

Insights

EU to Implement Minimum Tax Directive on Multinational Enterprises: Insights for CFOs and Corporate Tax Pros

CFOs and corporate tax professionals should monitor the OECD Pillar Two progress in the EU, especially in Member States where their organizations have a physical or digital presence. Plus, download a related guide.