Enterprise Value Increases to Drive Robust Automotive Supplier M&A Activity

Analysis indicates that global aggregate auto supplier enterprise values will increase over $400 billion by the spring of 2022 (two years after the pandemic began), leading to robust M&A activity in the next 24 months.

While economic, social, and pandemic-related factors continue to impact many businesses and create global uncertainty, a contrarian—that is, optimistic—viewpoint is emerging for the health and value of automotive suppliers over the next 24 months. Considering the sector’s history of a strong reemergence from the 2008-2009 economic crisis, automotive suppliers are more resilient and flexible than many give them credit for. Data analysis and recent interactions with numerous automotive suppliers, industry lenders, and private equity firms also suggest a favorable route ahead.

Although the industry is on a long-term path toward electrification and connectivity, the near-to mid-term dynamics offer equally pressing importance. It is important to consider these factors related to revenue, profitability, resulting enterprise value and how these elements may translate into increased mergers and acquisitions (M&A) activity.

Analysis of 2020 earnings and the impact for auto makers

Data from a representative sample of public automotive suppliers shows that 2020 was a challenge, but results were surprisingly better than expected despite the unpredictability largely spurred by the global pandemic.

Analysis indicates:

- 2020 revenue presented a 23% decrease from the prior year. Many investments in new initiatives likely had to be delayed due to lower than originally forecasted earnings.

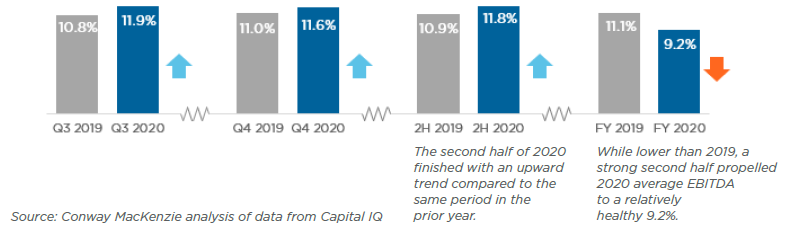

- The average EBITDA percentage achieved in 2020 was still 9.2% (versus 11.1% in 2019). Nearly half of the suppliers in the sample exceeded that average mark, and only one of the suppliers posted negative EBITDA for 2020.

- Relative to 2019, major impacts occurred in 2020 which should not be underestimated. Suppliers in the sample population alone lost an estimated $13 billion, or over $75 billion of enterprise value year-over-year, based on an EBITDA multiple approach.

- The average EBITDA dollars lost in 2020 compared to 2019 surpassed $300 million, with seven suppliers losing more than $500 million. In one case, a large Tier 1 supplier actually improved EBITDA margin by 15% in 2020 over 2019, but the depressed revenue levels still resulted in lower year-over-year EBITDA of almost $60 million.

At a time when the automotive industry is at an inflection point fueled by megatrends, the unforeseen disruptions that caused lost EBITDA delivered a staggering blow. The anticipated earnings that had been earmarked for future investment and strategic initiative funding may now be delayed, and the circumstances also resulted in depressed enterprise values.

Looking up: profitability better than initially expected

Some analysts initially predicted doom for the industry at the onset of the pandemic, but by adapting to the new operating environment, automotive suppliers’ ingenuity and agility are on display once again.

Looking deeper into profitability trends by quarter, supplier data for 2020 shows a sharp v-curve recovery in Q3 and Q4, with results continuing to outperform expectations (see Figure 1). Compared to the second half of 2019, the average EBITDA percentage in the second half of 2020 was nearly a full percentage point higher, and half the suppliers sampled showed improvement in cost of goods sold percentage over the same periods. Given the current industry headwinds, such as higher input costs and supply constraints, it will be interesting to see if the improving trends continue.

Figure 1:

Analysis suggests that automotive supplier profitability levels will likely hold in 2021 and potentially expand in 2022, with enterprise value roaring back over the next 24 months, based on the following assumptions:

Sales and Demand

- Sales levels in 2022 will meet or exceed 2019 sales levels as higher volumes continue and are bolstered by inventory replenishment.

- Customer preferences will continue to propel the truck and SUV market, causing the average selling price per vehicle in those segments to rise.

- In the near term, the adoption of EVs will not cause an immediate industry paradigm shift because adoption will be hampered by insufficient infrastructure, seasonal battery range anxiety, and high transaction prices.

- Platform mix will be a driver of the supply chain impacts to a supplier (prioritized SUVs/ trucks vs. passenger cars and delayed launches).

Company Operations

- Input and premium costs will decrease marginally from current elevated levels (raw materials, freight).

- The latter part of 2021 and the following year will present lessening impacts, constraints, and inefficiencies due to supply shortages (semi-conductors, rubber, resin, foam).

- Leading companies used the pandemic to accelerate restructuring actions that will bolster profitability in the future— this included closing plants, moving production, exiting non-core and/or less profitable businesses, and some of these changes have not yet realized full year improvement run rates.

- Certain cost reductions and new, more efficient ways of doing business discovered during the pandemic will become permanent, particularly in SG&A costs.

- Connected Factory (Industry 4.0) and operational performance improvement will continue to expand and be a priority to implement.

Economic Factors

- As government stimulus wanes, labor will return to a normalized supply and create a more competitive market.

- The unfavorable impacts of COVID-19 will continue to become more manageable as the effectiveness of policies, vaccines, and immunity increase.

- Improving macro-economic conditions and continued low interest rates may help boost M&A activity, which may accelerate in 2021.

- Capital availability (and in various forms such as SPACs) will fuel transactions and investment.

- Polices of the Biden administration and potentially unfavorable tax impacts are wildcards.

Strategic insights for automotive suppliers

Expectations for 2022-2023 indicate the automotive supply base will continue to focus on restructuring actions and executing strategic priorities. Predictions point to a more vibrant automotive M&A market.

Across the entire automotive supplier market, analysis suggests:

- Enterprise values in 2022 will be about 65% higher than 2020 levels.

- Enterprise value levels across the entire automotive supplier market may increase $400 billion and approach $1.1 trillion in 2022.

Source: Riveron analysis of data from Capital IQ

Traditional, process-focused suppliers will need to fortify leading positions. This can be done through acquisitions and active consolidation. Additionally, traditional suppliers should also divest from businesses that are under performing, non-core, or not poised for growth.

Innovative suppliers seeking growth in areas focused on CASE (connected, autonomous, shared, electrified) vehicles will need to continue to invest in forward-looking technologies. Such suppliers may increasingly consider partnerships that accelerate technology development. Additionally, suppliers might need to enact a narrower focus, divesting of growth areas that are difficult to fund, where they lack the current capabilities to develop, or areas that they no longer feel are the right industry bets to make as the landscape transforms.

Whether an automotive supplier finds itself in healthy or distressed terrain, M&A and restructuring activity over the next 24 months is necessary to position a supplier for longer-term success.