Capital Markets Signal a Strong Year Across SPACs, IPOs, and M&A

Riveron experts examine Q4 2021 activity and the capital markets trends shaping the year ahead.

The year ahead holds a promising capital markets outlook amid IPO and SPAC trends, ample M&A deal activity, and opportunities abound across many sectors despite ongoing complexities across the globe. The US economy found its stride again in the final quarter of 2021 after a weak September wiped out much of the previous quarter’s progress.

During the fourth quarter, US Gross Domestic Product (“GDP”) growth rebounded to 6.9% from a yearly low of 2.3% in the third quarter. In December, the unemployment rate continued to fall to 3.9% compared to 4.8% in September and below the pre-pandemic level of 4.4% in April 2020. Job gains across several sectors (leisure and hospitality, professional and business services, manufacturing, and construction) primarily drove the decrease in unemployment. In addition, the year’s market indices finished strong after stumbling in September. The S&P and NASDAQ showed gains during the fourth quarter at 9.4% and 7.4%, respectively, and it proved a great year for the stock market, with the S&P ending up 28.7% and NASDAQ up 22.2%. The quarter’s market increases occurred despite COVID surges from the Omicron variant and inflation rates hitting a 30-year high.

Available capital is good news for sponsors looking to finish a deal within the allotted window, as many sponsors currently face a “SPAC clock” expiration around the first quarter of next year.

Traditional IPOs trend strong and steer toward the technology sector

The traditional initial public offering (IPO) market ended the year on a high note, with 98 deals raising $47 billion in the fourth quarter compared to 94 IPOs raising $27.6 billion during the previous quarter. Traditional IPO activity maintained a furious pace in 2021, with 396 deals raising $153.5 billion —significantly larger than the 221 deals generating $78.2 billion in 2020.

In November, the IPO of electric vehicle maker Rivian made a huge splash when it raised over $12 billion, making it the largest IPO in the United States since 2014. Despite having less than $1 million in revenue in Q3 2021, the IPO is expected to generate an $8.2 billion gain for financial backer Ford Motor Co.

There are plenty of high-profile IPOs on the horizon for 2022, such as Instacart and Reddit, but the likelihood of rising interest rates in the upcoming year could dampen valuation expectations for high-growth technology stocks.

SPACs rebound and reveal rising stars

Special purpose acquisition companies (SPACs) continued to dominate the landscape of vehicles to access the public markets. The SPAC market saw a significant rebound in the fourth quarter, with 167 deals generating $45 billion compared to 88 deals raising $16 billion in the third quarter. In 2021, there were 613 SPAC IPOs that raised $162.3 billion, which greatly surpassed the 248 deals in 2020 that raised $83.4 billion.

The ride-hailing and delivery company Grab, based in Singapore, headlined the SPAC deals in Q4 with an impressive $4.5 billion capital raise. Combining with Altimeter Growth Corp. caused a $40 billion valuation, which made it the largest company ever to go public via a SPAC merger.

Reaching roughly one year since “peak SPAC,” many affected sponsors will need to find a target company in the near term—or deal with redemptions, which the market has recently seen an uptick. Despite more redemption activity and over $75 billion tied up in SPACs, there is still a healthy amount of capital on the table. Available capital is good news for sponsors looking to finish a deal within the allotted window, as many sponsors currently face a “SPAC clock” expiration around the first quarter of next year.

Technology sector fuels M&A activity

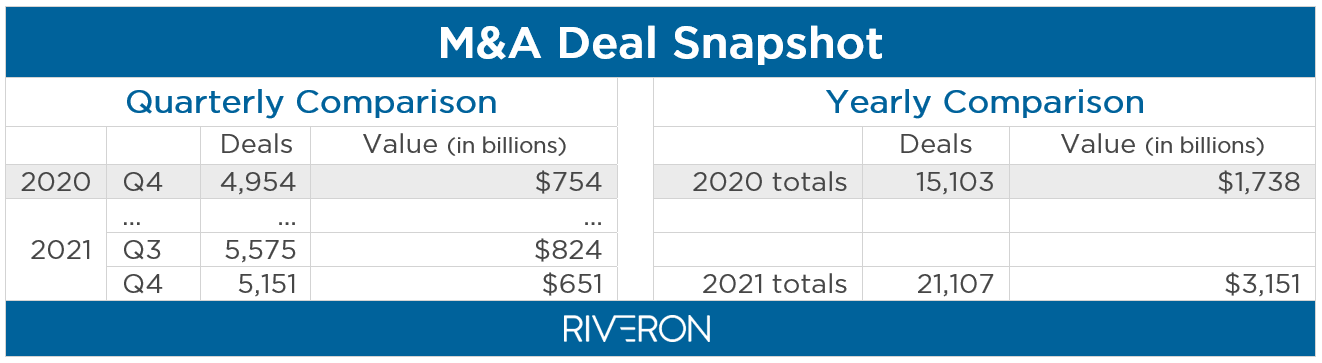

Despite a slight decrease from the previous quarter, mergers and acquisitions (M&A) activity for Q4 2021 maintained a high deal volume, although the overall value of the transactions was comparatively lower.

Source: data from Factset.

Source: data from Factset.

During Q4 2021, there were 5,151 deals valued at $651 billion which tallied lower in value compared to fewer deals that occurred in Q4 2020. Overall, deal activity and value totaled markedly higher compared to the previous year’s totals. This increase in year-over-year activity for the second, third, and fourth quarters was fueled by the technology services sector, which enjoyed an increase in fourth-quarter activity at 1,078 deals in 2021, up from 868 in the same quarter of the previous year. The announcement of software company Oracle acquiring Cerner, a medical records company, for over $27 billion headlined the M&A activity for the final quarter of 2021.

The path ahead is paved with potential

M&A, SPAC, and public listings activity persisted at high levels through the fourth quarter, which capped off a record year for capital markets. Along with that activity, the key market indices have bounced back from a rough September to close the year at new highs. However, the rise of inflation to 5.8% (using the Federal Reserve’s preferred gauge of PCE) has pushed the Fed to begin raising interest rates during 2022 after maintaining low rates to offset pandemic strains. There are continued concerns regarding supply chain disruption for many businesses and the effects of COVID variants that could hinder economic rebound in 2022.

Despite these risks and concerns, the capital markets persist with a large number of deals in the pipeline for SPACs, M&A, and IPOs that show a strong potential for business activity in the new year.