Navigating Supply Chain Challenges in the Consumer Products Industry

Historically high prices and capacity constraints continue to disrupt the consumer products industry. Initially driven by COVID-19, the outlook for commodity prices, production rates, shipping capacities, and port delays appears likely to remain challenged through the first half of 2022 and potentially beyond.

Ways the supply chain is impacting the CPG market

Pricing throughout the commodities markets has increasingly impacted industries and consumers. Markets have not seen similar widespread commodity price surges since the 1970s and, most recently, the financial crisis of 2008. Based on recent reports, various consumer goods (CPG) companies, including Procter & Gamble and Kimberly Clark, are raising prices across ranges of products to offset commodity cost inflation while consumers are spending more on gas and groceries and limiting spending elsewhere, shrinking profit margins for suppliers and manufacturers.

Restricted by travel blockages and response planning challenges, workers throughout Asia and the world experienced disruptions in factories and other labor positions. Now, as many workers are available to work on site, Delta variant-related outbreaks are causing further shutdowns and delays across China’s largest container ports as well as throughout front-line labor. In addition, maritime industry executives estimate 10% of the global container capacity is stacked on ships outside of congested ports and do not see a return to normalcy before early next year. Recently, ships waiting to port have exceeded the initial COVID-19 highs that occurred in 2020.

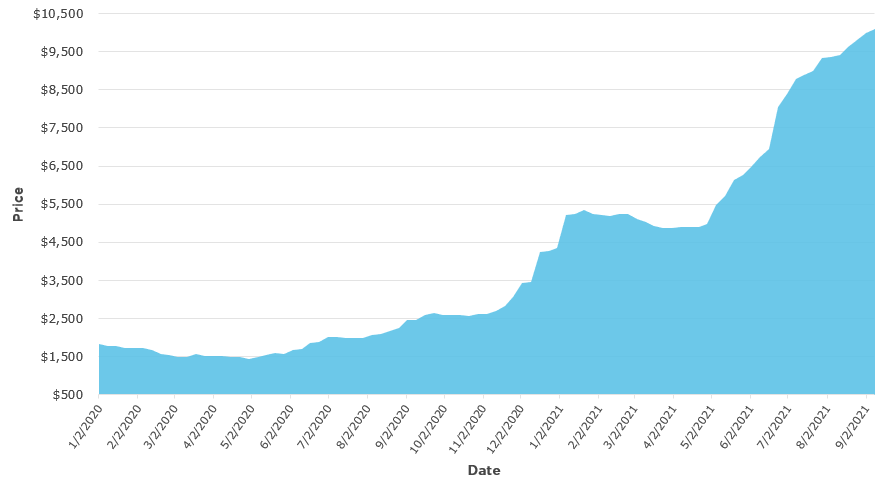

Port and shipping backlogs have caused exporters to struggle to find available slots on ships and, if needed, air freight. These backlogs are lifting freight rates as product demand remains steady and is projected to continue an upward momentum going into the holiday season.

Figure 1: WCI Composite Container Freight Benchmark Rate Per 40-Foot Box Price

Source: Riveron analysis of World Container Index (WCI) data from Bloomberg.

Today’s actions affect the future profitability of CPG companies

Higher commodity costs are pushing companies to seek opportunities to increase prices and cut costs across product sectors, and while some rising costs are being passed onto the consumer, a company’s success passing through price increases and the ability to leverage working capital and cash on the balance sheet will be imperative to weather the storm. Middle-market companies with tight liquidity may have fewer resources and leverage to absorb or push back on price increases, but these companies often have several internal levers they can address as well.

What companies should consider when navigating supply chain issues

Taking a proactive and integrated approach—involving customers and lenders as well as partnering with supply and freight vendors to understand current challenges—will better position the parties involved to continue to do business together successfully now and in the future. When considering how to navigate supply chain challenges, CPG companies can:

- Examine the 13-week cash flow, working with management to maintain updated analysis based on the current market. It is imperative to understand the sensitivities around timing and potential cost impacts for inventory receipts, deliveries and working capital to address cash needs using all available levers to support logistics demands. Unlike profit and loss statements that provide hindsight, 13-week cash flows look forward, helping management anticipate challenges in the weeks ahead as well as provide timing and value sensitivities based on current and predictive price changes. Companies can use the cash flow analysis to understand the timing between customer cash receipts as well as borrowings and payments to vendors to determine the timing of any shortfall and have anticipatory communications with their partners. A strong understanding of cash flow helps companies avoid scenarios where cash constraints hold the company hostage for profitable investments in inventory and capital expenditures.

- Ensure sales teams incentives are aligned to combat narrowing profit margins, as freight and commodity prices remain high and delays or disruptions might arise. As the challenge to pass through price increases or reduce volumes at profitable levels continues, company executives and sales teams must collaborate and be prepared to explore provisions allowing for temporary pricing increases or the ability to collect “surge pricing” to cover the reality of short-term costs. This approach may echo how market players addressed tariffs in 2019 and 2020, where companies often had to provide proof of the extra costs, time constraints, etc., to favorably navigate these increases as well as work internally to balance timing and communication.

- Maintain close relationships and communications with operations and logistics teams to anticipate capacity restraints and pricing fluctuations. Doing so—both internally and externally—is more important than ever, given the frequency and level of fluctuations likely to continue. Appreciating these sensitivities and upholding the ability to adapt solutions will determine success or failure over the next year.

- Reconsider adequacy of safety stock levels. Traditionally, tightly operated inventory models have reigned; however, given external fluctuations in timing, a different approach may be temporarily warranted. Under current conditions, it will be important to evaluate inventory levels to accommodate unforeseen—yet likely—scenarios where goods are stuck in port or COVID variants disrupt production channels delaying production and delivery. Safety stock as well as Chinese New Year and other holiday order schedules should be closely evaluated.

The impact of the pandemic —as well as resulting labor and commodity challenges— mandates each organization proactively analyze and adapt to existing issues. Companies may plan to address constraints by diversifying or changing production models in the future, but navigating these challenges now will ensure business continues favorably for consumer goods brands.