Leading Companies Aren’t Waiting to Disclose Their Climate Actions in the Proxy & 10-K. Neither Should You

It’s been nearly a year since the SEC publicly disseminated its proposed climate disclosure rules for publicly traded companies. Still, the rule has yet to be finalized. Some companies, anticipating lawsuits, delays, and changes to these rules, are biding their time, waiting to act until more solid direction and deadlines are set. However, there are a growing number of organizations getting ahead of the issue and already disclosing environmental initiatives in the 10-K and proxy. To get a better idea of how much this trend is progressing, we took a closer look at fiscal year 2020 and 2021 filings.

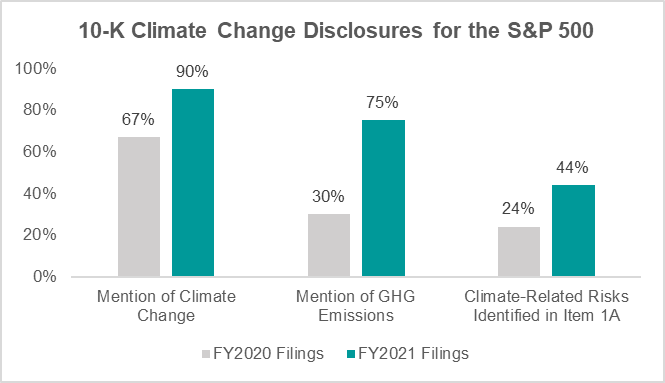

Investor-grade climate reporting is skyrocketing

We noted significant year-over-year disclosure enhancements including a dramatic jump in climate information included in SEC filings between 2021 and 2022, especially related to mentions of greenhouse gas (GHG) emissions in the 10-K, which are now on par with such mentions in the proxy. Overall, upwards of 90% of S&P 500 companies are now talking about climate change in the 10-K. And the proportion of companies calling out climate-related issues as specific risk factors in these reports has nearly doubled.

Source: Sentieo

Top sectors mentioning climate change in the FY2021 10-K filing included:

- Industrials

- IT

- Financials

- Consumer Discretionary

- Healthcare

Top sectors mentioning climate change in the 2021 proxy statement included:

- Financials

- Industrials

- IT

- Consumer Discretionary

- Utilities

Official mandates may still be pending, but the need for disclosure is not

Frankly, we’re not at all surprised by the past year’s dramatic increases in the number of companies disclosing climate-related initiatives and efforts outside of the traditional CSR and ESG reports. While it’s true that the climate disclosure rules are not yet set in stone, the SEC as well as investors and major frameworks are nevertheless making their expectations for more robust information and data on the issues quite clear. Furthermore, companies that are getting a jump on reporting and compliance understand these critical points:

- Meeting the new climate disclosure rule isn’t something that can happen overnight. Starting now—even taking baby steps—is the key to ensuring compliance when the rules do become official.

- The SEC is increasingly reviewing CSRs and calling out companies that include climate and other sustainability data and qualitative information in these reports but leave it out of the 10-K and proxy. If a company portrays the information in its sustainability report material, then the SEC maintains that it should also be included in official filings.

- Major institutional investors are making more and stronger public commitments on ESG issues, and climate risk in particular, and they expect companies to disclose material information on the issues in official filings.

- Perhaps most importantly, with more and more public companies enhancing their climate-risk disclosures in the 10-K and proxy, organizations cannot risk falling behind their peers and being seen as industry laggards.

The examples have already been set

If you are ready to take a step toward officially disclosing your climate actions, the good news is, you don’t have to start from scratch. There are multiple examples in other companies’ 2022 filings that can provide direction and guidance.

CLIMATE & CLIMATE RISK DISCLOSURES IN THE 10-K

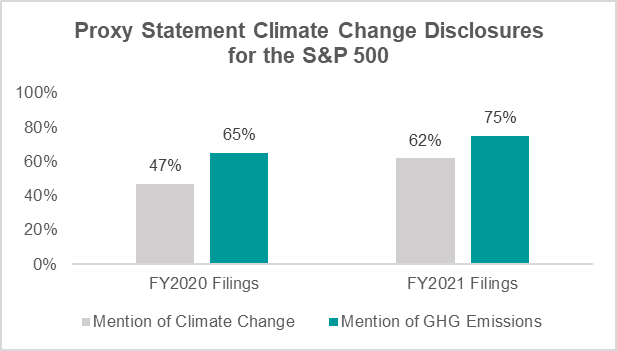

Even more so than the proxy, the 10-K is increasingly becoming a vehicle for climate disclosures. In annual reports covering FY2021, more than 90% of the S&P 500 mentioned climate change while just 62% discussed the issue in the proxy for the same year.

Within the 10-K, companies can discuss climate risk in the Business section (Item 1) and/or the Risk section (Item 1A). Companies that include disclosure of climate-related information in both sections demonstrate true understanding and integration of climate change impacts throughout their businesses.

Business Section (Item 1)

Generally, the Business section of the 10-K gives an overview of the company’s business and strategy, often this can include how board and management oversight of climate change are integrated into the overall business strategy of the company.

For example, under the “Climate Mitigation” section of the business overview, The Kroger Co., a grocery store chain, mentions its goals to reduce scopes 1 and 2 emissions 30% by 2030 based on a 2018 baseline. The company’s goals were developed in alignment with the Paris Agreement, supporting a below 2°C scenario. Kroger also discloses that it plans to set new targets in alignment with the Science-Based Targets initiative (SBTi) (1.5°C scenario) along with a new scope 3 emissions target. Kroger then points readers to its annual ESG report for additional information about its approach to managing climate effects (pg. 8).

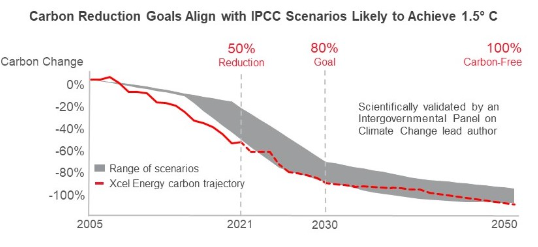

Xcel Energy Inc., a utility provider, also discusses climate in the Business section of the 10-K, using the graphic shown here to illustrate how its carbon reduction goals align with the widely accepted Paris Agreement goal to reduce emissions to a 1.5°C scenario (pg. 6).

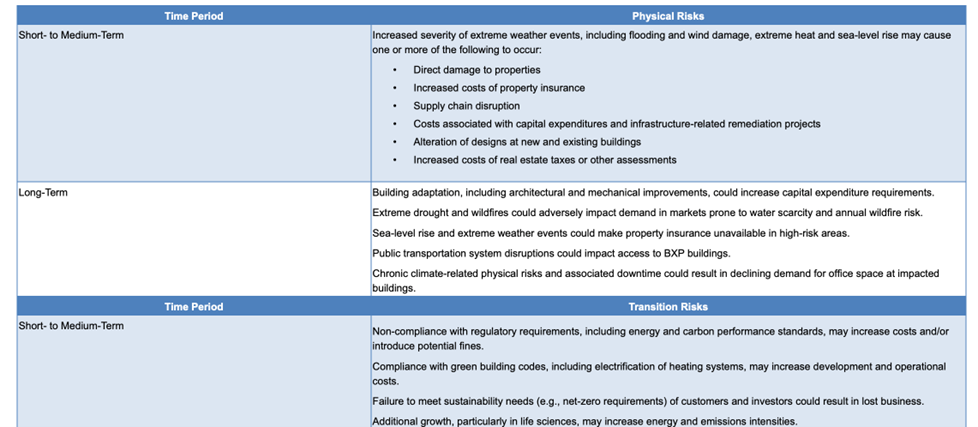

As a third example, Boston Properties, Inc., a real estate investment trust, includes an ESG section in the Business overview of its 2021 10-K, sharing energy and water data per SASB recommendations as well as providing disclosures in alignment with the TCFD framework, including outlining physical and transition risks associated with climate change (pgs. 13-17).

Risk Factors (Item 1A)

Just a few years ago, climate change-related risks were mostly identified within a larger risk category in the 10-K, such as natural disasters and legal risks. Some companies still take this approach. However, many companies are moving toward including a standalone climate risk section in Item 1A. Regardless of where companies discuss climate risk, it is important to note that, overall, the proportion of companies identifying climate-related risk as a risk nearly doubled in filings filed between 2021 and 2022, with the financials, industrials, information technology, real estate, and materials sectors being the most likely to release such information. Additionally, whether the disclosures are included in other sections or on their own, companies are clearly framing up the significant implications of climate risk for many aspects of their businesses.

Climate as a supply chain risk

Stanley Black & Decker, Inc., a manufacturer of cutlery, industrial tools, and household hardware, for example, discusses climate issues in the first risk statement in Item 1A, noting the company’s risks associated with sourcing and manufacturing and highlighting the risk of finding suppliers that meet its environmental standards (pg. 10).

“The Company’s ability to find qualified suppliers who meet its standards, including a majority having carbon emission reduction targets, and supply products in a timely, cost-effective and efficient manner is a significant challenge with the increasing demand from customers, especially with respect to goods sourced from outside the U.S. For certain products, the Company may rely on one or very few suppliers.”

Climate as a legal and compliance risk

Amcor PLC, a global packaging company, discusses climate risks in its legal and compliance risk category explaining that the company sees heightened customer expectations as a threat if the company cannot meet the higher standards enforced by key customers (pg. 21).

“Many of our large, global customers are also committing to long-term targets to reduce greenhouse gas emissions within their supply chains. If we are unable to support customers in achieving these reductions, customers may seek out competitors who are better able to support such reductions. A failure, or perceived failure, to respond to expectations of all parties, including with meeting our own climate-related and other ESG target ambitions, could cause harm to our business and reputation and have a negative impact on the trading price of our common stock.”

Climate risk as a standalone factor

When organizations choose to treat climate risk as a standalone factor, they can list it in the General Risk Factor section, as Adobe Inc., a computer software provider, has done in its 2021 10-K. The company includes a detailed statement with examples of potential risks related to the various locations where it operates as well as a statement of its alignment with TCFD (pg. 34).

“Climate change may have a long-term impact on our business.

[…] While we seek to partner with organizations that mitigate their business risks associated with climate change, we recognize that there are inherent risks wherever business is conducted. Access to clean water and reliable energy in the communities where we conduct our business, whether for our offices or for our vendors, is a priority. Our major sites in California, Utah and India are vulnerable to climate change effects. For example, in California, increasing intensity of drought throughout the state and annual periods of wildfire danger increase the probability of planned power outages in the communities where we work and live. While this danger has a low-assessed risk of disrupting normal business operations, it has the potential impact on employees’ abilities to commute to work or to work from home and stay connected effectively. Climate-related events, including the increasing frequency of extreme weather events and their impact on U.S., India and other major regions’ critical infrastructure, have the potential to disrupt our business, our third-party suppliers, and/or the business of our customers, and may cause us to experience higher attrition, losses, and additional costs to maintain or resume operations. To accurately assess and take potential proactive action as appropriate, Adobe is aligned with the guidelines of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures recommendations and the Sustainability Accounting Standards Board environmental metrics.”

GHG-specific climate risks

In filings covering FY2020, companies were much more likely to mention GHG emissions in the proxy than the 10-K. While mentions in both filings covering FY21 increased, 10-K mentions saw the most dramatic jump—from 30% to 75%—especially among larger-cap companies. Interestingly, the financial sector is not one of the top sectors to discuss GHG emissions in its 10-K despite being a top sector to include such information in the proxy. Top sectors included industrials, IT, consumer discretionary, healthcare, and consumer staples.

Jacobs Solutions Inc., an engineering, architecture, and construction company, treats climate risk as a standalone factor, housing it within a section entitled “Risks Related to Climate Change” (pg. 44). In addition to specifically mentioning the potential material adverse impact of climate change on the business and the impact of market and regulatory responses to climate change, the company states,

“We may be unable to achieve our climate commitments and targets.”

It goes on to describe the circumstances outside of its control including specific mention of “mandates or requirements relating to GHG emissions, carbon costs or climate-related goals.” The company ends the section by stating:

“Further, investors have recently increased their focus on environmental, social and governance matters, including practices related to GHGs and climate change. […] If we are unable to meet our climate commitments and targets and appropriately address sustainability enhancement, we may lose investors, customers, or partners, our stock price may be negatively impacted, our reputation may be negatively affected, and it may be more difficult for us to compete effectively, all of which would have an adverse effect on our business, results of operations and financial condition.”

Capri Holdings Limited, a global manufacturing and fashion holding company, also specifically addresses GHGs in its 10-K under a standalone disclosure of climate risk (pg. 27) with the following information:

“Our business is susceptible to the risks associated with climate change and other environmental impacts which could negatively affect our business and operations.

[…] In April 2020, we announced a global strategy to achieve significant, measurable goals across a range of important environmental and social sustainability issues, including, material sourcing, reducing greenhouse gas emissions and converting to renewal energy, responsible water use and waste reduction. We may not be successful in attaining our goals, and even if we meet our commitments, there remains a significant risk that climate change and other environmental events could negatively impact our operations.”

CLIMATE DISCLOSURE IN THE PROXY

The best place for climate-related disclosures to appear in the proxy generally depends on the maturity of the ESG program at a given company. The governance section is a great place to start, and companies can provide additional details as their programs become more developed.

Governance

The governance section is typically the first-place climate is mentioned in the proxy. Initial disclosure may begin with board member ESG credentials and then evolves into the board governance section dedicated to the relevant aspects of ESG. Furthermore, in the proxy, the mention of climate risk remains confined to the corporate governance section.

As an example, in its FY2021 proxy statement, AGCO Corporation, an agricultural manufacturing and distribution company, discloses that ESG oversight is divided among board committees with the Governance Committee specifically responsible for the company’s sustainability issues including climate-related risks (pg. 15):

Standalone ESG Section

Climate discussions can also appear in a standalone ESG section of the proxy, which is often located in the Proxy Summary. If the company has taken any noteworthy climate-related actions, these will always be highlighted in some form, and such a standalone section is the ideal place to disclose them, so they do not get overlooked.

In the introduction of the Campbell Soup Company, a food manufacturing company, proxy, the summary includes this statement about GHG emissions (pg. 6):

“In fiscal 2022, we set approved science-based targets to reduce greenhouse gas emissions across our supply chain. We committed to reduce absolute Scope 1 and 2 greenhouse gas emissions 42% by fiscal 2030 from a fiscal 2020 base year. In addition, we committed to reduce Scope 3 greenhouse gas emissions from purchased goods and services and upstream transportation and distribution by 25% within the same timeframe. “

Compensation Discussion and Analysis (CD&A)

As companies mature in their ESG journey and have set GHG goals and targets, these may appear in the required CD&A section of the annual proxy statement because such goals are often used to incentivize executives.

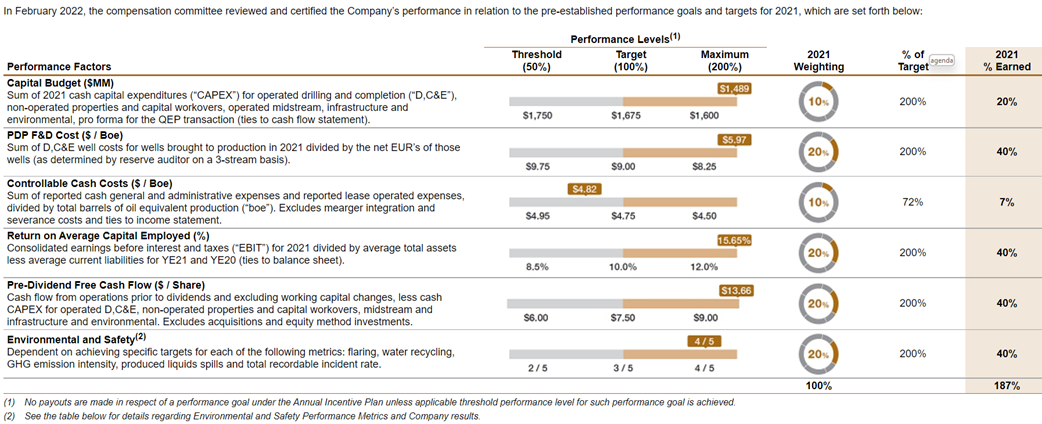

Diamondback Energy, an oil and natural gas company, includes a GHG emission intensity target within its Environmental and Safety performance factors in the executive compensation program (pg. 53):

Start creating investment-grade climate-risk disclosures today

As the data and examples illustrate, a majority of companies are not waiting for the SEC mandates to become official to begin their climate-risk reporting journeys. If your organization has some catching up to do, there are several easy steps you can take now that can help prepare you for your 2023 filings and beyond.

- First, acknowledge upcoming legislation. Even though the rules are not yet final, it is a good idea to understand exactly what you may need to disclose and when. Use this as a starting point to gauge where you stand should the rules as proposed today become official in the next year or two. What items are you ready to report on now? Where do you need to gather more information? The answers to these questions can help you start building your climate-risk reporting readiness roadmap.

- Next, benchmark your company compared to your peers. Review your competitors’ filings to understand what they are already sharing and how much real estate they are devoting to disclosures around climate change and climate risk in the 10-K and proxy. This is a great indicator of what you are up against and how you may be penalized by rating agencies and investors who will be performing their own comparisons.

- Review climate-related risk oversight and board qualifications. These items are the table stakes for disclosures in your filings. If you have not yet checked this to-do item off your list, move it into the high-priority category right away. For more information on putting together a strategy for board-level ESG oversight in general and climate risk in particular, see our recent post on moving toward an integrated board oversight model.

- Conduct a climate risk assessment. If you haven’t already done so, conducting a climate risk assessment should be another high-priority item on your list. A climate risk assessment is one of the most effective ways to identify where you are exposed when it comes to the impacts of climate change, especially if you have suppliers, warehouses, or facilities located in areas that are or can be impacted by severe weather events. If your company has scope 3 emissions targets and/or more stringent supplier standards to help you achieve your greenhouse gas emissions goals, you may be even more exposed than you think.

Above all else, get the expert support you need

Investor-grade climate reporting is no small undertaking. Even companies that have been sharing climate data for years in their CSRs will need to take numerous steps to make sure the information is ready for the 10-K and the proxy. For these filings, both climate data and financial controls expertise are integral to your climate reporting efforts, and ideally you should have both types of experts working collaboratively on these initiatives for your firm. If you have questions or need additional guidance, give us a call to learn more about how we can help you fill in the gaps. We can help define a comprehensive approach to developing the climate-risk disclosures you should be filing today, and may be required to file tomorrow.