A Sneak Peek at Early 10-K Filers: 4 Ways Companies are Disclosing Climate Risk in the 10-K

If 2021 was the year for “S” disclosures in 10-K filings, we expect 2022 to be the year for “E”. Major institutional investors including BlackRock, Vanguard, and State Street continue to bolster climate change and ESG expectations in 2022 proxy voting guidelines, and ISS and Glass Lewis are following suit. Further, the U.S. Securities and Exchange Commission (SEC) is poised to require climate risk disclosure to some extent in the coming months and that disclosure will most likely be required within the 10-K.

Below we take a sneak peek at 10-K filers to see how companies are approaching TCFD and climate risk disclosures from an investor perspective.

But before diving into 2022 filings, let’s look back at environmental, social, and governance (ESG) trends in 10-K filings from 2019 to 2021.

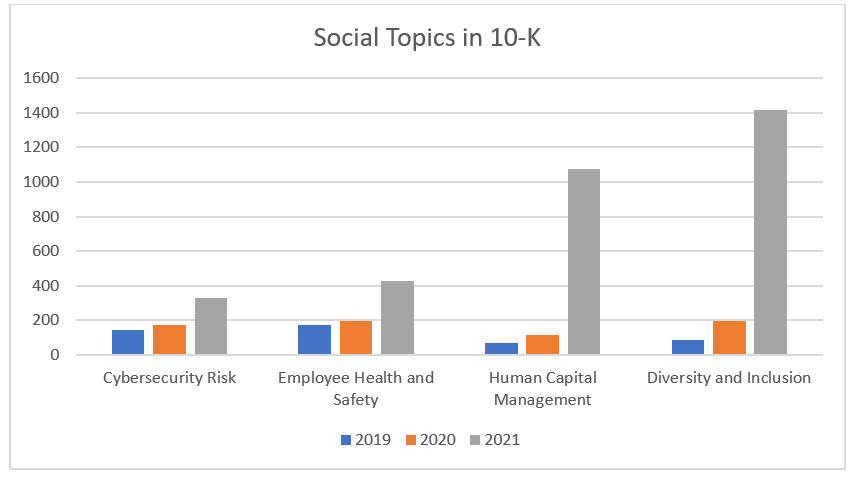

Growth of Social Terms in 10-K Filings

In general, ESG topics have all been on steady rise in the 10-K and elsewhere. They began trickling in several years ago. Last year in particular, the proportion of companies studding their 10-K prose with social or “S” terms, such as “human capital management” and “diversity and inclusion,” skyrocketed, underscoring the growing importance of these social issues in investment decisions.

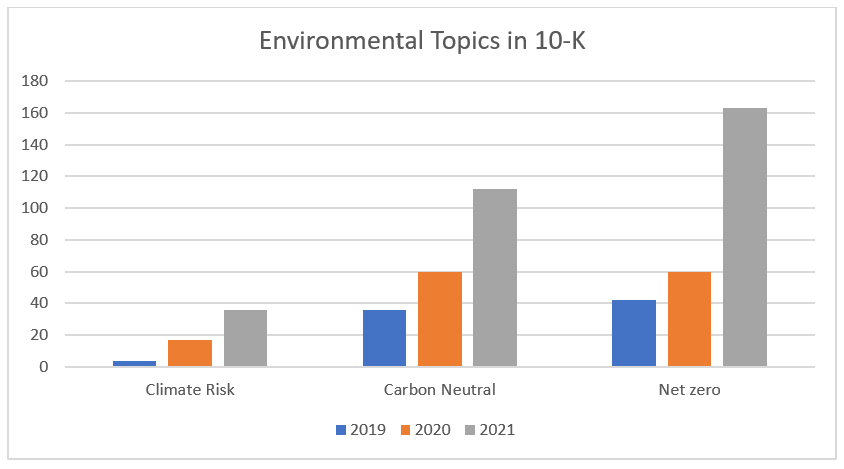

Growth of Environmental Terms in 10-K Filings

Given the recent dialogue around climate change, including statements from investors, proxy advisors, and the SEC itself, we fully anticipate a new surge of “E” phrases in filings this season. Indeed, we’ve already seen an increase the past few years, with an uptick in the use of environmental buzzwords such as “climate risk” and “carbon neutral” and “net zero”. But the question remains, what do these buzzwords really mean?

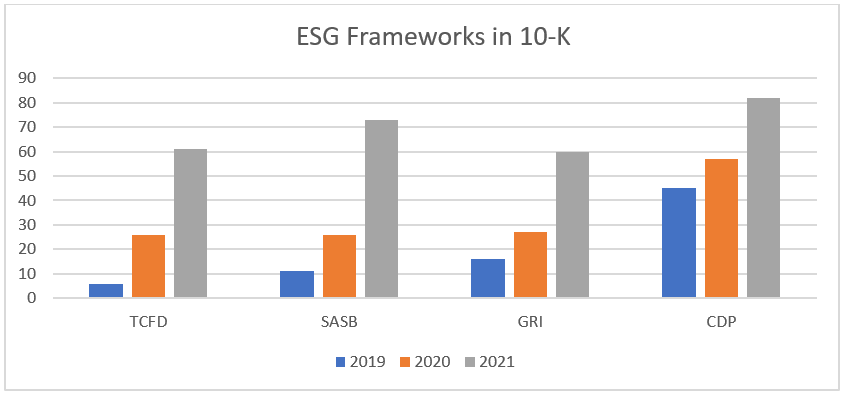

Growth of Framework Mentions in 10-K Filings

It is no secret that ESG reporting companies generally align with one or multiple ESG frameworks such as SASB, GRI, TCFD, or CDP. Some may find it surprising, however, that the most referenced ESG framework in 10-K filings from 2019 to 2021 was CDP.

It is worth noting that while we do expect the forthcoming International Sustainability Standards Board (ISSB) global standards to impact framework trends, GRI is not included in the ISSB consolidation, and the Task Force on Climate-related Financial Disclosures (TCFD) is a participating member of the ISSB working group.

Everyone is looking for the E.

Various players have made their expectations for enhanced climate risk disclosures in the 10-K perfectly clear. Major institutional investors including BlackRock, Vanguard, and State Street continue to bolster disclosure expectations related to climate change and ESG. For BlackRock, CEO Larry Fink specifically reiterated his company’s desire for climate risk reporting aligned with the TCFD framework in his 2022 letter to CEOs.

Proxy advisors have also made their positions well known. This year, ISS will likely take proxy recommendation action against high-emitting companies for lackluster climate oversight disclosure. And earlier this month, Glass Lewis announced the launch of ESG Profile, a supplement to its Proxy Paper research reports that scores companies on criteria including whether or not they report aligned with TCFD and the robustness of their disclosures. For some companies, the new profile page also includes a specific climate risk mitigation score.

What’s more, the rules keep changing. The IFRS announced the formation of a new consolidated International Sustainability Standards Board (ISSB), which is expected to provide a “comprehensive global baseline of high-quality sustainability disclosure standards to meet investors’ information needs” by June 2022 along with a separate specific framework for climate change. And while the jury is still out on the timeline and breadth of the SEC’s forthcoming new rule on climate change disclosure, regulators around the globe continue to push for enhanced discussion of climate oversight and corporate social responsibility.

A few things we do know in the U.S., a recent SEC comment letter made it clear that companies should be thinking about material climate change disclosure in the Risk Factors section, MD&A, and any material past and/or future capital expenditures for climate-related projects. Additionally, companies should not provide significant climate-related disclosures in corporate documents that are excluded from SEC filings.

Early 2022 filers are responding accordingly.

We’re seeing a variety of climate risk disclosures from issuers who have filed the 10-K thus far in 2022. Overall, companies are upping their games. But to what degree seems to depend on how much data and information a company has available or is willing to disclose.

Here are four main approaches companies are taking, along with a few examples to consider.

1. Tabular or Quantitative TCFD Disclosures

As far as investors are concerned, the more decision-useful climate risk data a company can provide, the better. Among early 10-K filers, most are mentioning the importance of climate change oversight, and many companies, including Mondelez and Cummins Inc., reference external TCFD Reports and external Corporate Sustainability Reports for fuller quantitative or tabular climate risk reporting. Alexandria Real Estate Equities Inc. is one company that has reported tabular or quantitative TCFD disclosures in the 2022 10-K. The company’s annual report (pgs. 103-104) specifically references alignment with TCFD methodology when it comes to assessing and mitigating physical risks to its properties. The report includes the following chart to explain the steps the company is taking for each of its property types:

COMPREHENSIVE APPROACH TO ASSESSING & MITIGATING PHYSICAL RISK:

| Acquisitions • Conduct climate change assessment. • Incorporate potential mitigation strategies, where applicable, into financial modeling and transactional decisions. |

| Developments and Redevelopments • Review climate change assessment. • Assess potential risks and account for 2050 climate projections and an RCP 8.5 scenario. • Consider physical and operational measures in design to increase the property’s resilience. • Identify operational mitigation measures and ongoing monitoring opportunities. |

| Buildings in Operation • For new and redeveloped assets transitioning into operations: • Consider implementation and prioritization of operational mitigation measures and ongoing monitoring. • For existing assets: • Review climate change assessment. • Where potential risks have been identified, assess to what extent mitigation measures are in place and which operational and physical improvements can be made to increase the property’s resilience. • Develop an implementation plan. |

Some companies were already taking a quantitative climate risk reporting approach last year. Hanon Armstrong Sustainable Infrastructure, for example, explored the impacts of climate change on future operations in its 2021 10-K (pgs. 55-62), The company included components of the TCFD framework throughout its document and incorporated scenario analysis, as in the excerpt below, with both qualitative and quantitative impacts discussed.

Example: Scenario 1 – Global action is taken to limit the global temperature increase to 1.5 degrees Celsius above pre-industrial levels

| Assumption | Qualitative Impacts | Quantitative Impacts | Considerations of and Impact on Our Management Strategy |

| The price of Renewable Energy Credits (“RECs”) or similar structures increase as more aggressive renewable portfolio standards and corporate renewable energy targets are implemented | Increased expected cash flows and financial returns for certain of our investments to the extent the RECs are sold at higher market prices.

Increased debt/lease service coverage ratio for the obligors of our renewable energy debt investments and solar real estate leases that sell RECs at higher market pricing. The resulting increase in cash flows may also allow us to apply greater financial leverage to these investments and enhance our profitability. If there was a material increase in value associated with RECs, it is likely that more renewable energy projects would be developed in geographic areas where the RECs were more valuable, leading to more potential investment opportunities for us. |

If the overall price level of RECs increased by 5% we would not expect a material impact to the overall cash flows from our existing investments. The is largely due to the lower value of RECs in comparison to power prices in most of the markets where our investments are located. | We may identify more investment opportunities resulting from the increased REC value. In addition, to the extent that our investments become more valuable we would consider whether it would be more economical to our stockholders to either monetize the investment given the increase in value or continue to hold in our Portfolio and maximize our returns from adding additional leverage to our financing. |

2. Qualitative Descriptions

Where significant quantitative data is not yet available or ready to disclose, issuers appear to be opting for detailed qualitative descriptions in the Business Description section or elsewhere that sprinkle in quantitative metrics.

For example, the following discussion of climate and energy appears in Intel Corporation’s 2022 10-K (pg. 15). The disclosure touches on the amount of energy conserved since 2020, the proportion of renewable energy the company uses globally, and its future goals in both areas. The text also drives readers to the company’s Corporate Responsibility Report and website where additional disclosure—mapped to the TCFD, the Sustainability Accounting Standards Board framework, and the CDP Climate Change Survey—are available for review.

| Climate and Energy |

| We focus on reducing our own climate impact, and over the past two decades have reduced our direct emissions and indirect emissions associated with energy consumption. Through our 2030 goals we have committed to conserve an additional 4 billion kWh of energy over 10 years. We have conserved more than 310 million kWh1 of energy since 2020. We also continue to link a portion of our executive and employee performance bonus to our corporate sustainability metrics. In 2021, this included our target to save 125 million kWh of energy during the year. We also invest in green power and on-site alternative energy projects in support of our 2030 goal to achieve 100% renewable energy use across our global manufacturing operations. We have reached 81%1 renewable energy globally. We are committed to transparency around our carbon footprint and climate risk and use the framework developed by the TCFD to inform our disclosure on climate governance, strategy, risk management, and metrics and targets. For governance and strategy, we follow an integrated approach to address climate change, with multiple teams responsible for managing climate-related activities, initiatives, and policies. Strategies and progress toward goals are reviewed with senior executives and the Intel Board of Directors’ Corporate Governance and Nominating Committee. We describe our overall risk management processes in our Proxy Statement, and describe our climate-related risks and opportunities in our annual Corporate Responsibility Report, the Intel Climate Change Policy, and “Risk Factors” within this Form 10-K. In addition to what is included within this Form 10-K, information about and progress toward our 2030 goals is included in our Corporate Responsibility Report. Our Corporate Responsibility Report also includes a mapping of our disclosure to the TCFD, the Sustainability Accounting Standards Board framework, and our CDP Climate Change Survey, all of which are available on our website. |

The Dow Inc. 2022 10-K (pgs. 62-64) provides another good example of robust qualitative description related to climate change matters. The text breaks down the conversation to cover transition risk, physical risk, and climate action, including the organization’s goals for 2030 and 2050. Dow makes mention of TCFD and references its 2020 ESG report and its forthcoming 2021 ESG report for additional disclosures aligned to the framework.

| Climate Change Climate change matters for the Company are likely to be driven by several categories of risks related to the transition to a lower-carbon economy (“Transition Risks”) and risks related to the physical impacts of climate change (“Physical Risks”).Transition Risks Transition Risks include carbon pricing mechanisms, transition to lower greenhouse gas emissions technology, increased cost of raw materials, and mandates on and regulation of existing products and services. Carbon pricing is a market-based strategy to address climate change by putting a monetary value on greenhouse gas emissions, allowing for the costs of climate impacts and opportunities for low-carbon energy options to be reflected in production and consumption choices. Approximately 35 percent of Dow’s Scope 1 and 2 greenhouse gas emissions are generated from operations in Canada and the European Union (“EU”) where carbon pricing is already in place. As part of the European Green Deal, the European Commission proposed a 2030 greenhouse gas emissions reduction target of at least 55 percent below 1990 levels, with a goal for the EU to be carbon neutral by 2050. In China, an emissions trading system, initially proposed to cover the power sector only, is expected to gradually expand to cover a total of eight sectors, including the petrochemical and chemical industries, though no specific timeline for implementation and expansion has been outlined. |

3. Risk Factors

In its sample letter to companies, the SEC requested additional information specifically on the material effects of transition risks related to climate change that may affect the business, financial condition, and results of operations, such as policy and regulatory changes that could impose operational and compliance burdens, market trends that may alter business opportunities, credit risks, or technological changes.

Companies are beginning to bolster climate change language in the Risk Factors section, describing both physical and transition risks. MGM Growth Properties details physical risks in the Risk Factors section of its annual report (pg. 25), noting that properties are subject to risks from natural disasters such as earthquakes, hurricanes and severe weather, and other potential risks and costs associated with the effects of climate change.

| Our properties are subject to risks from natural disasters such as earthquakes, hurricanes and severe weather, and other potential risks and costs associated with the effects of climate change. Our properties are located in areas that may be subject to natural disasters, such as earthquakes, and extreme weather conditions, including, but not limited to, hurricanes, floods, tornados, wildfires, and winter storms, and such conditions may be further exacerbated by the effects of climate change. Such natural disasters or extreme weather conditions may interrupt operations at the casino resorts, damage our properties, and reduce the number of customers who visit our facilities in such areas. A severe earthquake in Las Vegas could damage or destroy a number of our properties. In addition, our operations could be adversely impacted by a drought or other cause of water shortage. A severe drought of extensive duration experienced in Las Vegas or in the other regions in which we expect to operate could adversely affect the business and results of operations at our properties. Although the tenants are required to maintain both property and business interruption insurance coverage for certain extreme weather conditions, such coverage is subject to deductibles and limits on maximum benefits, including limitation on the coverage period for business interruption, and we cannot assure you that we or MGP BREIT Venture, as applicable, or the tenants will be able to fully insure such losses or fully collect, if at all, on claims resulting from such natural disasters or extreme weather conditions. |

Selective Insurance Group Inc. discusses transition risks in its annual report (pg. 27), detailing the financial implications of an economic low-carbon transition, increased policy and regulations, and/or low-carbon technology advancements.

| Our investment portfolio also has climate change-related transition risks. Transition risks arise from society’s transition towards a low-carbon economy, driven by policy and regulations, low-carbon technology advancement, and shifting sentiment and societal preferences. This transition can lead to stranded assets in areas such as the fossil-fuel and automotive industries. It can also result in increased costs to reinvest in and replace infrastructure and litigation against fossil-fuel companies. Transition risks can lead to corporate asset devaluation, lower corporate profitability, lower property values, and lower household wealth. Transition risks may reduce the market value of some energy, transportation, and other investments with high carbon footprints or those closely tied to carbon-based economic activity. As of December 31, 2021, sectors identified as carbon intensive within our fixed income securities portfolio represented less than 5% of our total invested assets. |

4. Climate Risk Oversight and Forward-Looking Statements

Not surprisingly, investors and proxy advisors have been most interested in high-emitting companies. Even though the framework originated in the financial sector (to help mitigate the financial system’s exposure to climate-related risks by giving lenders, insurers, and investors insight into how companies would endure or struggle with climate change) — proxy voting action and contentious situations mostly targeted high emitting companies last year.

Today, companies in industries with inherently smaller carbon footprints typically remain less prepared to share their climate risk strategies and successes, simply because they haven’t been under the same investor pressure to do so.

As the framework becomes more mainstream and climate risk awareness and disclosure become increasingly critical for all companies in all industries, laggards can demonstrate a willingness to catch up by publishing forward-looking statements and/or discussions around climate risk oversight that outline their plans for future TCFD-aligned reporting.

For example, the Associated Banc-Corp 2022 10-K (pg. 16) includes a detailed section on climate-related risk management and governance. In the report, the company discusses the growing importance of climate-related financial risk management and the role of banks in mitigating that risk. The text goes on to describe the organization’s Environmental Sustainability Risk Policy and Environmental Sustainability Statement as well as its intent to align reporting metrics with the TCFD framework. Finally, Associated Banc-Corp specifically outlines board oversight for all ESG topics including climate-related risks.

| The Corporation’s Board of Directors is responsible for overseeing the corporate ESG strategies and risks of Associated, including risks and opportunities related to environmental sustainability. In fulfilling its responsibilities, the Board has delegated responsibilities to the following Board-level committees: •The Corporate Governance and Social Responsibility Committee (CGSRC) has oversight responsibility for the company’s ESG Framework and ESG Disclosures. •The Enterprise Risk Committee of the Board of Directors (ERC) is the approval authority for enterprise risk-related oversight, such as risk-related policies and the Risk Appetite Statement. With regard to environmental sustainability, this includes Environmental Risk Management; Climate Change, Carbon Emissions and Natural Resources; and Environmental and Social Lending. |

What Does This All Mean?

Even though net-zero commitments and climate risk discussions are on the rise, the problem is far from solved. According to a recent report by McKinsey & Company, all public commitments combined (from more than 70 countries and 5,000 companies part of the United Nations’ Race to Zero campaign), would likely not be sufficient to keep warming below 1.5°C. Further, public commitments often differ from what’s happening on the ground.

“Yet even if all the existing commitments were fulfilled, greenhouse gas emissions between now and 2050 would still likely exceed the potential budget of what scientists consider necessary to keep warming below 1.5°C. Moreover, these commitments have yet to be translated into implementation plans. Execution would not be easy: it would require a careful balancing of the shorter-term risks of poorly prepared or uncoordinated action with the longer-term risks of insufficient or delayed action.”

Our advice this year is to begin the climate risk data collection and reporting process, and try not to remain silent on climate risk altogether. We believe that starting with the CDP questionnaire is an important first step. Investors and other stakeholders view this as a proactive approach and a long-term commitment.

Like most companies, you’re probably in the process of enhancing your organization’s climate-risk monitoring and reporting strategy. So, when it comes to reporting in your 2022 10-K, a lot will come down to where you stand in collecting the underlying data, metrics, targets, strategy, and risk management processes. If you can’t provide climate risk information on any level, it is time to build internal climate risk management and reporting processes.

Need some help? Contact us to learn more about our approach and to better understand how we can help craft your narrative.