Integrated Diligence: Bringing Continuity to the Transaction Lifecycle

Successfully executing a business deal is a complex endeavor. Whether buying or selling a business, companies face numerous obstacles when determining if a transaction is the right fit. To assess risk and determine the viability of a potential investment, buyers and sellers rely on due diligence for a better understanding of the investment thesis, value proposition, and long-term prospects. This process often involves a deep dive into a company’s financial health, operations, systems, processes, culture, and potential legal exposure. Often, key stakeholders compartmentalize various diligence workstreams, which may result in failure to see the big picture and the inability to collectively assess an investment opportunity.

Today’s complex business environment, shaped by a volatile M&A landscape, requires an integrated diligence process that spans the range of activities in the transaction lifecycle and is designed to maximize value for every transaction.

Approaching diligence in an integrated manner minimizes communication gaps and increases connectivity while enabling clear insight into the full range of diligence activities. Without it, third-party specialists often focus on one or two aspects of diligence without holistically examining the investment thesis. This results in the need to coordinate efforts across different specialist teams, costing them valuable time and money.

But today’s complex business environment, shaped by a volatile M&A landscape, requires an integrated diligence process that spans the range of activities in the transaction lifecycle and is designed to maximize value for every transaction. As a result, clients and other key stakeholders can expect a better coordinated and more efficient process that stands out for its ability to offer timely insights into the entire breadth of diligence activities.

Given today’s robust middle market deal environment, an integrated diligence approach is even more pressing for companies that are trying to scale their business and attract the right buyer or seller. In 2018, there were nearly 3,000 US middle market transactions totaling $428 billion in deal value with market multiples remaining consistent. In short, navigating the deal journey will be a competitive process ripe for integration given the traditionally siloed or partial approach employed by most companies.

As the deal landscape broadens, companies should identify diligence providers that are best suited to help them get the deal done. The right provider will guide clients throughout their transaction journey with an integrated approach that examines the unique characteristics within each transaction and incorporates them into a customized plan.

By viewing diligence activities as part of a continuum, companies can identify the right deals that align with their long-term goals. As a result, companies will be better positioned to mitigate risk and uncover crucial opportunities.

Our Approach

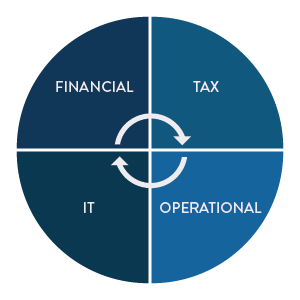

At Riveron, we evaluate financial, tax, operational, and IT aspects of the M&A lifecycle from evaluation to exit. By understanding where our clients have been and, more importantly where they are going, we offer insights-driven guidance that surpasses the standard diligence exercise. Our primary diligence focus areas include:

Financial: We perform comprehensive analysis of the financial landscape for a target company or assets to identify and quantify the associated risks and opportunities that are critical to a successful transaction.

Tax: Every transaction has tax implications that can greatly impact the value of a deal, but the complex and continuously changing regulatory environment can make it difficult to identify the best solutions. We partner with companies to proactively address tax risks and opportunities to effectively navigate any transaction.

IT: Our holistic approach to IT diligence considers the target’s systems, infrastructure, people, processes, and security to gain an understanding of current business needs, the scalability of current systems, and a plan for the future state of the business.

Operational: We assess the target’s current financial and operational performance against its competition and industry best practices to evaluate performance gaps, evaluate key business drivers, and create a roadmap to accelerate synergy capture.

Integrated Diligence in Practice

When a middle market private equity firm was considering adding a new company to its portfolio, it engaged Riveron to provide integrated diligence services in order to validate its investment model and determine whether it should move forward with the transaction. Beginning with financial diligence, we ensured there were no red flags that would impact the viability of the deal. From there, we assessed potential tax liabilities that could extend to the client following the acquisition. Additionally, we evaluated the quality and scalability of IT systems as a platform acquisition, including areas that could be improved during the hold period. Throughout this process, we streamlined requests in order to ease the burden on both the client and the seller. By using an integrated approach, we were able to look holistically at the entire investment opportunity and serve as a strategic single service provider across workstreams.