How CFOs Can Do More With Less Using the Technology You Already Have

Balancing financial constraints with a desire to automate and scale, CFOs and private equity leaders alike are seeking ways to recalibrate their operations—and must uncover ways to do so using existing technologies.

In today’s constrained business environment, chief financial officers (CFOs) are being tasked with achieving more with less. As a result, the accounting and finance teams at many companies are delaying big technology purchases and instead seeking to optimize and make the most efficient use of the technologies already at hand. And due to slowdowns in the deal market, many organizations within the private equity lifecycle are reevaluating ways to drive value by shifting focus toward optimizing business operations and reducing costs.

Unlocking possibilities: why CFOs are optimizing existing technologies

Technology and data-related issues are causing many constraints in the way today’s companies operate, particularly for accounting and finance teams. Companies that have recently undergone a series of acquisitions may now be faced with duplicative customer relationship management (CRM) tools, enterprise resource planning (ERP) software, and budgeting and forecasting tools. Following these acquisitions, if company leaders fail to allocate the necessary time and resources for the seamless integration of systems and processes, employees are left to spend countless hours making manual adjustments and rectifying data discrepancies across various applications and touchpoints.

Operating without a cohesive approach to technology only exacerbates existing system issues and creates unreliable, disparate data sets. When companies are experiencing high-growth periods, their technology and software purchases are often a tactical fit — an essential fix for a given timeframe but not an overall strategic solution that fits the business growth plans.

Enabling efficiency and streamlining siloes: In many cases, a company’s use of technology is misaligned to its current needs. This can happen because key users and buyers of those point solutions and tactical-fit software may no longer be at the company. Inefficiencies can also occur when multiple parties implement siloed technology solutions.

Example: misaligned tech across various accounting and finance functions

One company’s treasurer implemented a specialized solution to address a specific cash management issue, while the controller procured a separate tool for close management, and the FP&A leader utilized another application for driver-based planning. Although these solutions may individually address the immediate concerns of each area, the overall collection of tools lacks proper integration, involves multiple vendors, and does not follow a platform approach. Additionally, it seemed that the technology selection process did not explore the possibility of using an existing application to resolve the challenges faced by other leaders. To overcome this siloed approach, the company needed to streamline and make a more interconnected use of the technologies at hand.

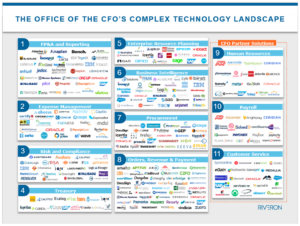

Endless technology options equal wide-ranging impacts: The Office of the CFO is increasingly reliant on technology to enable better accounting and finance processes, guide transparent and sound decision-making, and influence favorable business outcomes. Under each CFO’s purview exists a wide range of available technology solutions across a complex landscape that includes everything from financial reporting to enterprise resource planning and risk management to order-to-cash processes; plus, this landscape is often highly fragmented and can become more complex when layering in internal or external CFO partner functions including human resources, customer service—and beyond.

Problems can arise for CFOs —and the organization as a whole— if someone is trying to buy a point solution to deal with each of the focus areas depicted in Figure 1 and not considering how the needs and outcomes are interconnected. Sometimes there is one platform solution that covers most of the needs within each sub-function; other times CFOs need to work with their technology teams to ensure different solutions will integrate.

When problem-solving, it’s important to consider:

- how the data flows across the organization, and whether there are opportunities for automation

- how to automate the integration of point solutions where processes have historically been manual

- ways to reduce the number of applications and move to a platform that can solve the needs of the multiple business functions depicted in Figure 1 above

The Office of the CFO is central to this problem-solving process as it is the main consumer of the output and the interconnected impacts. Further, CFOs are motivated to optimize their systems and reduce costs to be able to do more with less: they can simplify complexities by reducing the number of applications, reduce manual effort (and eliminate along with it the need to hire more people in a constrained labor market), and create the ability to scale without adding headcount. In addition, many CFOs are removing old technologies and moving to platform solutions, which can be disruptive but impactful by removing the manual processes of otherwise-constrained accounting and finance teams.

A better approach to acquisitions: CFOs often grapple with the technology-related inefficiencies that occur in private-equity-backed organizations or other companies undergoing multiple acquisitions. Recently, the market has been so active and acquisition-focused that a lot of organizations ended up with duplicative systems with multiple add-ons and bloated licensing costs with multiple users on multiple platforms.

Example: streamlining technology after multiple acquisitions

One company had over 20 legal entities that collectively owned more than 10 ERPs, multiple instances of CPM, and four e-commerce solutions. By rationalizing the application landscape, this cost-saving effort reduced the company’s licensing footprint, duplicative applications, and consolidated portfolio. Plus, the savings from user licenses and software costs alone covered the investment required to improve the company’s systems.

In the example above, the CFO drove a business case around cost reduction, complexity reduction, and operational efficiencies with shared service components. In cases where an organization has many acquisitions and different ERPs —where potentially dozens of key employees know how to work within a unique ERP— leaders can consolidate and strengthen the organization’s purchasing power by instead using a unified ERP and a shared service model for accounting. The CFO desired to get more out of the technology and avoid many systems and processes doing the same task path, cut complexity, and remove errors. By migrating all entities to a new, single instance of NetSuite ERP, the organization could:

1) Reduce costs by:

- Spending fewer hours of finance or accounting employees to compile or reconcile data

- Reducing audit-related costs and tax filing costs

- Establishing the potential to consolidate certain finance and accounting roles

- Reducing the user counts and overall number of applications (such as Planful or Quickbooks) and the associated licensing or integration costs

2) Reduce complexities by:

- Creating a fresh start based on a future-state design of simplified entity structure setup, business units, inventory, and other key factors

- Removing unwanted configurations or customizations

- Enabling simpler reporting by tapping into the built-in dimensionality offered by the ERP

- Reducing errors and simplifying intercompany allocations and transfer pricing

- Improving the ease and effectiveness of integrations after a merger or acquisition

3) Operate more efficiently by:

- Creating the ability to use a shared-service accounting model within one instance, as well as shared services for planning, purchasing, and warehouse

- Establishing centrally-managed, streamlined stock and safety stock levels regardless of business unit

- Aligning with the consolidation of manufacturing and finished goods locations

- Utilizing one SKU per inventory item

- Simplifying demand planning

Ultimately, the approach helped reduce technology-related costs while the shared-services model (within the ERP) drove efficiency across the accounting team. It also made management reporting and other hard-to-get data much more easily accessible.

CFOs are using available technologies while avoiding unnecessary new investments

Optimizing existing technologies can be an attainable path to success versus a large undertaking of implementing an entirely new system. Especially for accounting and finance teams, new technology products are not always the right answer. Many leaders already have the tools they need within one or more of their company’s existing ERPs, or they can use what’s available within the tech stack of a company they’ve recently acquired. In other cases, companies aren’t tapping into the entire functionality of the tools they have already purchased. Investigating the capabilities of the tool can help optimize and simplify the process.

Doing more with data: Unnecessary workloads can burden the Office of the CFO when an organization’s data isn’t consolidated, requiring brute force —headcount— rather than making operations more streamlined through the smart use of technology. In the worst of these cases, companies continue to hire more people to do the same tasks that can be automated. Additionally, if mergers and acquisitions are planned, data can be even harder to manage with a hodgepodge of ERPs but no roadmap or plan. This gives rise to more pain points, processing fatigue, additional headcount, and additional cost. When these data-related pain points arise, CFOs and company leaders can address these challenges by better using the technology at hand—and doing so in a coordinated manner.

Example: after a merger, reporting can be more useful by leveraging dimensions within the existing ERP

At one growing organization, two recently merged entities were using the same technology but inefficiencies still surfaced. Separate naming conventions disrupted operational reporting and caused the need for frequent manual intervention by employees to correct the data. This prevented them from focusing on more value-added tasks. Instead of implementing something new, the team leveraged the dimensions available within the existing ERP, which the company had not previously utilized. The approach helped the company to group and segment the data according to the desired key performance indicators.

In the example above, the company had been using NetSuite but needed to take advantage of the available dimensionality in order to get better reporting by tracking revenue and expenses in detail. Rather than refer to complex account codes within the chart of accounts, a multidimensional approach uses customizable labels, such as department or location (see Figure 2). These labels, known as dimensions, are more intuitive to use and act as tags that group and filter data, similar to sorting data in a spreadsheet. Including this information in transaction records allows CFOs and business leaders to facilitate better analysis and reporting and guide informed decision-making.

Often companies can make reporting more robust, targeted, and easier to access by setting up dimension-related functionality that already exists within the technology at hand.

Why should accounting and finance leaders address these technology needs now?

While there is never a “perfect” time to get started on recalibrating technology to enable better accounting and finance operations, it helps to recognize common constraints. When the demands of audit season wind down, companies have a narrow window before budgeting and planning season ramps back up. This timeframe is one of the most practical times to make optimizations. Savvy leaders often use mid-year timeframes to make ongoing enhancements to their technology and operations.

If leaders avoid taking action in the short term, then another year will roll around, and companies will continue facing the same pain points from the previous audit cycle. Instead, companies can choose to mobilize the one-time expense and effort to reduce the costs and issues associated with the upcoming audit cycle and finally resolve the ongoing accounting and finance issues.

Now—between audit season and ramping up for next year—is an ideal time to optimize a company’s technology and refine avenues for automation. This is especially true for private equity-backed organizations because many PE leaders have shifted their focus from making new acquisitions to enhancing their portfolio companies.

When CFOs drive efficiencies, revenue and growth will follow

It’s essential for today’s CFOs and private equity leaders to optimize consistently and simplify their processes. Leaders must address “band-aid” solutions with a more optimized, forward-looking use of their technologies. Driving these efficiencies can help increase revenue, margin, and growth. By reducing costs and optimizing operations, companies can achieve more with less, and CFOs can enable their organizations to focus on long-term strategic growth.