Audit Readiness: Top Focal Points for a Smooth Audit Cycle

As companies balance constraints as the annual audit approaches, accounting leaders should be mindful of five key themes, as well as a sound approach to project management, in order to work effectively with auditors and make the best use of the resources at hand.

For the Office of the CFO, getting ready for the annual audit can be a difficult balancing act, particularly as accounting teams are facing more constraints than ever and are trying to make sense of the increasing complexity in their company financials.

What to do now: key themes for ensuring a smooth audit cycle

As CFOs and accounting leaders guide their organizations through the annual audit cycle, the standard conventional advice might include things like “think ahead by putting a well-equipped accounting team in place” or “embrace automation and accounting technologies that reduce manual effort and errors.”

Although these tips are true and helpful in elevating your accounting and finance functions, it’s now the first quarter, and the annual audit is here — on top of everything else that kicks off in the first part of the year for the Office of the CFO. As the audit starts in earnest now, many businesses don’t have the time to implement automation or restructure their teams during year-end and the early part of the year. At this point, accounting and finance teams simply need to get through the audit cycle in the most efficient and effective manner possible — preferably using the resources at hand.

So, where should the Office of the CFO focus to guide audit cycle success? There’s no silver bullet, but focused project management is a key place to start, along with being mindful of five themes likely to impact the current audit cycle.

First things first: practical ways project management can help companies tackle the annual audit

For accounting leaders and companies heading into an audit (whether you feel ready or not!) focused project management is going to be a lifeline. In practice, this means an accounting team needs someone to “own” the audit as part of their day job. This responsibility normally falls to a company controller but it’s also an opportunity for talented accounting leaders to step up. Regardless of whether a company appoints someone in the organization or enlists outside help to focus on the audit, someone has to manage the effort to be mindful of task prioritization and how dependencies will impact the success of an annual audit.

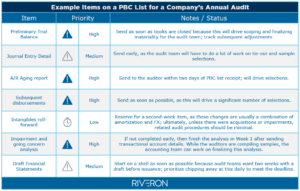

One essential step that may seem obvious: the controller can look at the “prepared by client” (PBC) list provided by the external auditors and should prioritize which information the accounting team should compile and send to the auditors first to keep all parties moving forward efficiently.

Leaders should structure how their team attacks the PBC list in a way that keeps the auditors moving based on the dependencies of the actual audit testing. Accounting teams should look at the list and think about the items that represent the first step of audit testing and those that are in and of themselves the final deliverable.

Priorities should include any items that represent a detail that will require sample testing or confirmations like the A/R aging, inventory detail, or detail of accrued liabilities. These can be quick wins, and they will get the auditors moving toward the next step, which is normally tie-out and sampling. Packaging that information up as soon as possible and in a way that is intuitive for the auditors can greatly increase efficiency. An inventory detail that does not agree to the general ledger and have support for the reconciling items adds another step in the process, but it will move things forward to craft a clean, well-organized deliverable that agrees to the general ledger. This approach puts the ball in the auditor’s court on Day 1 and frees up the accounting team’s limited time to work on the more technical items that may call for deeper scrutiny and judgment, like impairment analyses or documenting complex transactions like a debt refinancing.

During the first week of the audit, accounting teams should also loop in other departments (HR, FP&A, or others) that may have a dependency feeding into the discussions with the auditors. It can be especially helpful to include the in-house FP&A team because that department prepares forecasts related to critical items such as impairments, which is covered in more detail below.

Here’s an example of a prioritized list of audit items:

There’s no one-size-fits-all approach for a company’s annual audit and PBC list, but it helps to aim for tactical, quick wins that keep the audit team busy making sample selections in the first week while giving the accounting team time to wrap up technical items. This can be critical to maximizing the efficiency of both the audit team and the accounting team – during the earliest stages of the audit cycle and throughout the process. The nuances of project management and audit task prioritization can make a difference in keeping a step ahead of the auditors and hitting the deadline, especially for corporate accounting teams that are short-staffed.

Top 5 themes to prepare for the current audit season

While each business organization is unique, the Office of the CFO should be mindful of several themes that might affect the current audit cycle. These audit season focal points include (1) accurately addressing impairment, (2) understanding the nuances of revenue recognition, (3) revisiting the company’s costing methodology and booking adjustments, if necessary, (4) navigating complex financing transactions, and (5) accounting for any recent mergers and acquisitions (M&A) activity.

AUDIT READINESS THEME #1

Accurately addressing impairment

In a recent webinar (watch the replay here) that explored topics impacting the forthcoming audit season, accounting experts from Riveron highlighted the importance of a company’s impairment analysis. Getting the impairment analysis right can be the difference between a smooth finish and a cascading impact of last-minute changes in the financial statements.

To accurately account for impairment, CFOs and corporate accounting professionals should expect auditors to place significant emphasis on the order of the impairment analyses. A company must first prepare documentation of long-lived asset impairments before moving to indefinite-lived assets and goodwill. Long-lived asset impairment analysis will require the identification of asset group as well as cash-flow forecasts at an asset-group level. Forecast data is particularly subject to audit scrutiny in the context of the economic challenges that continue to affect businesses across many industries.

Impairment analyses are always subject to judgment and proper application of the impairment model. Even if an impairment analysis is not completed at the audit kickoff, accounting teams should talk through items that may impact the analysis, like asset groupings and forecasts to ensure alignment on approach. If an impairment needs to be recorded, the recognition and disclosure of impairments in financial statements are of particular importance and may require the use of a valuation specialist. To calculate an asset’s impairment, take the carrying value of the asset (the historical cost minus its accumulated depreciation) and subtract its fair market value. It’s essential that these calculations are accurate and properly documented to avoid audit issues.

AUDIT READINESS THEME #2

Understanding the nuances of revenue recognition

Most companies have already implemented the revenue recognition accounting standard, ASC 606. Now that companies have had a few years of experience with ASC 606, many are looking at how to apply ASC 606 to new revenue streams and whether the initial adoption conclusions continue to represent the revenue of the business. Revenue is always an area of scrutiny for auditors and a focus area of audit testing.

In addition, many companies are uncovering areas for improvement with regard to revenue recognition even before auditors flag it as a potential issue. One reason is that the turnover of accounting staff remains a common trend across many organizations — and when an experienced accounting professional steps into a company’s vacant seat, it can reveal that the company has been following approaches to revenue recognition that now need to be updated or better aligned to generally accepted accounting principles. In other words, a recently hired accounting professional will draw from their experience at a previous organization and be able to apply revenue recognition principles that are more aligned to industry practice, relevant, and useful.

A fresh perspective on the appropriate application of ASC 606 can reveal the need for further scrutiny and potential adjustments. For example, a company accounting leader might realize that the company has been accounting for revenue with an amortization schedule that is longer than necessary and overly conservative, and the company may need to conduct a review of business practices to ensure that they are appropriate. There are a variety of reasons that might cause companies to reassess their revenue recognition practices:

- New products and services: Many companies continue to evolve their products to a recurring revenue model, which may require a revisiting of the pattern of revenue recognition.

- Changes in business practices: As technology changes, the way that products are delivered and services are managed continues to change, which may have impacts on how companies evaluate their revenue recognition practices.

- Preliminary estimates: Many companies established their ASC 606 revenue recognition practices based on preliminary judgments and estimates of how certain products and services would be delivered. With several years of experience, companies may want to revisit these original conclusions to see if they still fit what the company does today.

A proactive approach is crucial to correctly account for revenue recognition and ensure success across ASC 606-related audit items. Accounting and finance professionals should meticulously review their company’s revenue contracts and ensure consistent application of the five steps:

- Identifying the customer contract: Clearly define the agreement and its scope.

- Identifying the contract’s performance obligations: Pinpoint the distinct promises made to the customer.

- Determining the transaction price: Accurately quantify the total consideration expected.

- Allocating the transaction price to the performance obligations: Apportion the revenue to each obligation based on its relative value.

- Determine when to recognize revenue: Recognize revenue when control is transferred to the customer.

It can be complex to revisit a company’s revenue recognition practices. Companies need to be able to demonstrate a documented change in business conditions that drives the change and explain why changes are not merely the result of an error in applying the accounting guidance.

By proactively addressing these complexities and ensuring adherence to ASC 606 principles, companies can navigate the audit season with confidence and demonstrate a sound approach to financial reporting.

AUDIT READINESS THEME #3

Revisiting costing methodologies

During earlier stages of the pandemic, many companies faced significant supply chain issues, which resulted in increases in the cost of inventory. Many companies also apply an average costing approach to inventory that reflects purchasing trends. Then, as supply chains normalized, many companies began to refine their purchasing trends and see a return to more normalized prices. As a result, there could be a need to revisit any inventory costing that was built up during a high-cost period to understand if that inventory standard should continue to be applied or should be adjusted based on more recent trends. As the audit season approaches, accounting teams should prioritize understanding their costing methodologies in preparation for audit testing.

To stay ahead of potential scrutiny, proactive companies can conduct their own in-depth analysis before auditors begin price testing. This self-assessment can identify discrepancies and allow for adjustments during the closing process, especially where significant purchase price variance has started to be capitalized onto the balance sheet. Although it’s ideal to address concerns well before year-end, it’s still helpful to review costing before the audit testing begins in earnest. Taking action to identify and correct outdated costing will strengthen a company’s financial reporting and demonstrate internal control effectiveness.

Here are key steps for a proactive costing review:

- Compile thorough documentation: Document costing practices, including assumptions, data sources, and allocation methods.

- Conduct an internal analysis: Perform internal analyses to assess whether the costing methodology accurately reflects operational realities and expense patterns.

- Complete relevant price testing: Conduct rigorous price testing to validate the accuracy of estimated costs against recent purchases — especially important as pricing may have evolved significantly in recent months compared to the initial onset of the pandemic.

These proactive measures will help companies avoid surprises in their price testing procedures during the audit, knowing their costing methodologies are accurate and well-documented. As price testing is highly driven by large sample sizes, discrepancies in this area of the audit can lead to incremental sample sizes, adjustments, and potential delays in the audit deadline.

AUDIT READINESS THEME #4

Navigating complex financing transactions

Looking back, it’s no secret that 2023 was a very uncertain year from a macroeconomic standpoint as companies recovered from pandemic-related pressures, adapted to new trends, and managed higher interest rates. These kinds of environments can often trigger a need to refinance existing obligations or seek new capital. Managing complex financing transactions stands as a crucial theme in the audit process.

Auditors will also place a high level of scrutiny on these types of transactions, as many complex financing transactions have embedded features that offer investors certain upside scenarios and protection against certain downside scenarios that may have separate accounting implications. This is particularly relevant for developing and growing companies that may have used some form of bridge financing to sustain the company in the last year. Companies should keep in mind several things when evaluating the accounting for complex financing transactions:

- Document conclusions in a memo: Auditors will want to see the documented conclusions regarding the accounting for these transactions in a memo. While companies may be able to get all of the debits and credits right, they should still document their conclusions to facilitate audit review.

- Allow time for an incremental specialist’s review: These types of transactions will often be reviewed by more than just the audit team but also by the audit firm’s national subject matter experts. Accounting teams should consider the incremental time for these reviews but also keep the status of these reviews as a consistent talking point for audit status calls so that all parties are held accountable.

AUDIT READINESS THEME #5

Accounting for any recent M&A activity

If an organization has experienced any mergers or acquisitions during the past year, it will be important to reach out to auditors early in the cycle to make them aware of the business combination. A business combination often requires the engagement of specialists beyond the audit team, particularly valuation specialists. Managing the review by the specialists during their busiest time of year can become a bottleneck for audit completion if clear expectations are not set early.

Auditors will pay particular attention to the following items:

- Calculation of consideration: Purchase consideration is the starting point for accounting for business combinations and, therefore, absolutely critical to get right, but it will also be subject to judgments about what’s considered “in” versus a transaction outside the business combination.

- Impact to share-based compensation: Changes to share-based compensation can be one of the most complex areas of business combinations because the guidance is extremely nuanced and requires a full understanding of arrangements that existed before and after the transaction.

- Identification and valuation of assets: Often a critical component of accounting for a business combination is the proper identification and valuation of the assets and liabilities acquired.

Looking ahead, it’s also helpful to keep in mind that there are many best practices that can be gleaned from going through the process of a post-M&A audit cycle. Organizations that complete an acquisition usually have plans to complete additional acquisitions, or perhaps another type of transaction, such as an IPO, in order to continue their plans for strategic growth. Learning from the areas that come under scrutiny during this audit cycle can inform what to look for during future diligence, acquisition, and integration phases so that accounting and finance operations are integrated as seamlessly as possible and that audit cycles will go smoothly. For example, one company learned during its initial acquisition that auditors focused on auditing the closing balance sheet and effective cutoff as of the acquisition date, so for subsequent acquisitions, its accounting team was able to effectively focus on getting a clean cutoff for subsequent acquisitions. This allowed the team to proactively address inconsistencies and prevent common issues that can arise during the annual audit. Read more by exploring related success stories here.

Preparing for a successful audit cycle

While it may be too late in the audit cycle to form an ideal approach by “starting early” or “automating processes,” accounting and finance teams can still be successful. Companies can meet their audit deadlines through focused project management and by being aware of the critical audit areas described above that may require more time and attention.

Audits can be challenging but provide investors and key stakeholders a much-needed pulse, supporting confidence in a company’s ongoing financial reporting.

Once an accounting and finance team has successfully managed its audit, it may be beneficial to reflect by looking back to gain insights from the latest audit cycle and thinking about ways to streamline the approach for next year — while also celebrating that just getting through the audit is an accomplishment in and of itself.