AI in Your Accounting Toolbox: Practical Applications and Overcoming Hesitations

Today’s accounting and finance professionals can embrace AI technologies to improve processes and elevate the strategic impact of the office of the CFO.

The true power of AI lies not just in automation, but in its ability to unlock deeper insights from financial data.

The world of accounting and finance is on the cusp of a significant transformation. Artificial intelligence (AI) is no longer a futuristic concept, but a powerful set of tools with the potential to revolutionize the way financial professionals operate. While some might be hesitant to embrace this change, AI offers significant advantages for streamlining processes, improving accuracy, and freeing up valuable time for strategic analysis. Today’s accounting and finance professionals should explore practical ways to leverage AI while understanding and addressing common concerns for its adoption.

Understanding AI in Accounting and Finance: Defining Key Terms

First, here’s a breakdown of some widely used terms and how they connect to the world of accounting and finance:

- Optical Character Recognition (OCR): This technology extracts text from images and digital documents. In accounting, OCR can be used to automatically convert scanned invoices, receipts, and other documents into digital data. This saves time and reduces errors compared to manual data entry.

- Machine Learning (ML): This is a type of AI where algorithms learn from data without explicit programming. In finance, machine learning can be used to analyze vast amounts of financial data to identify trends, predict risks, and automate tasks like fraud detection.

- Artificial Intelligence (AI): This is a broad field of computer science focused on creating intelligent machines. Machine learning is a core component of AI, but AI encompasses other techniques as well. In accounting, AI can power tools for automating tasks, analyzing data, and generating reports.

- Generative AI (GenAI): This is a subfield of AI focused on creating new data, like text, images, or code. While not as widely used in accounting yet, GenAI has the potential to create financial reports or marketing materials tailored to specific audiences.

- Large Language Models (LLMs): These are powerful AI models trained on massive amounts of text data. They can perform tasks like writing different kinds of creative content, translating languages, and answering your questions in an informative way, just like I am doing now! In accounting, LLMs could be used to generate summaries of financial data or create narratives for financial reports.

Below are practical examples that tie these concepts together.

AI in Action: Streamlining Workflows Across Accounting and Financial Processes

Imagine an accounting team uses an OCR tool to convert a stack of invoices into digital data. This data is then fed into an ML model that analyzes spending patterns and identifies potential areas for cost savings. The insights from the ML model are used by the accounting team to create financial reports. In the future, GenAI might be able to automatically generate different versions of these reports tailored for different audiences, and an LLM could be used to write clear and concise explanations of complex financial data within the reports, which helps with decision-making.

This is just one example. AI can be applied across the entire record-to-report (R2R) process, from automating order processing and invoice generation to expediting data analysis and reconciliation during the closing process. Consider the order-to-invoice stage:

- AI-powered order processing systems can leverage Natural Language Processing (NLP) to understand order details and automatically populate fields in the company’s ERP system. ML algorithms can analyze historical data to identify potential pricing discrepancies or credit risks, prompting further review before order confirmation.

Beyond Efficiency: AI for Strategic Advantage

The true power of AI lies not just in automation, but in its ability to unlock deeper insights from financial data. Large Language Models (such as Chat GPT, Google Gemini, or similar technologies) can be used to generate clear and concise explanations of complex financial data within reports. Generative AI has the potential to create customized reports tailored for specific audiences, such as a more detailed report for management and a simpler one for the board.

Imagine a CFO receiving a report that not only summarizes financial performance but also identifies trends, highlights potential risks, and suggests courses of action. This AI-enabled approach empowers finance teams to move beyond data entry and become true strategic partners within an organization.

AI in Accounting: Example Use Cases

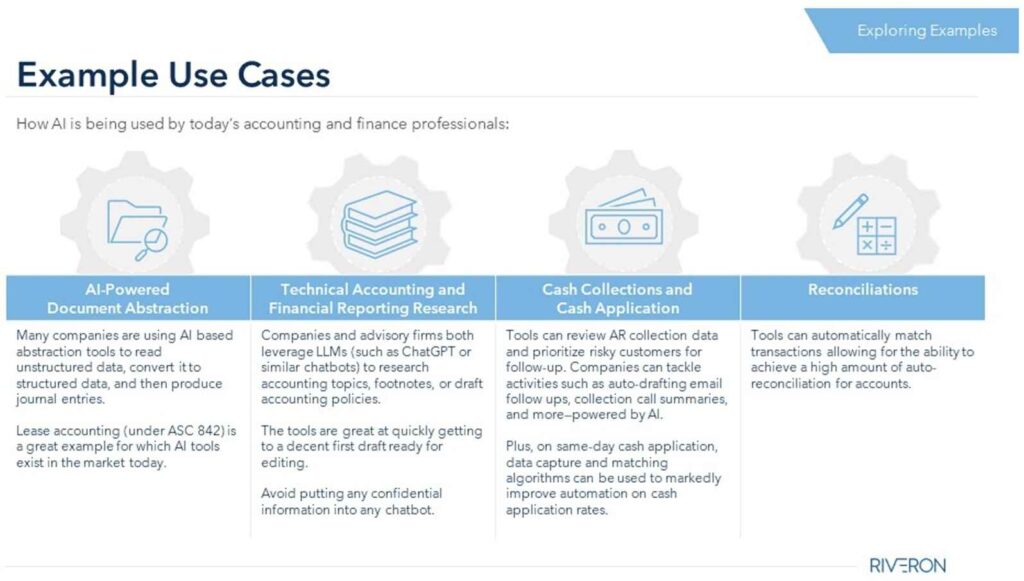

From technical accounting research to reconciliations, there are many ways accounting and finance professionals can make use of AI. The following image highlights a few possibilities, and additional examples are explored in more detail below. Plus, review additional AI accounting use cases by watching a related expert discussion.

Addressing Concerns When Adopting AI

While the possible benefits of AI are clear, many accounting and finance professionals might have reservations about adopting AI-powered technologies. Here are common concerns and how to address them:

- Cost of AI Implementation and Integration: Integrating AI solutions with existing accounting systems can be complex and expensive. Consider a phased approach, starting with a pilot program in a specific area like accounts payable (AP) automation. Here, it can help to consider cost-effective, cloud-based AI solutions. Ideally, customizations will be avoided or kept to a minimum, meaning that any built-in features of new AI-powered accounting or finance tools will be easy-to-use and integrate with any existing technologies that an organization intends to continue using.

- Lack of Trust and Transparency: Some AI models can be like “black boxes,” making it difficult to understand their decision-making process. To address this concern, CFOs and accounting leaders can look for solutions that offer explainable AI (XAI) capabilities, allowing the ability to see the reasoning behind the model’s outputs. Accounting and finance leaders can also work with their IT teams to request additional documentation from providers, such as Service Organization Control (SOC) reports, which can help alleviate data security concerns.

- AI and Accountants’ Job Security Concerns: The fear of AI replacing human accountants is a valid one. However, AI is meant to augment human capabilities, not replace them. By automating routine tasks, AI frees up time for finance professionals to focus on higher-level analysis and strategic thinking. Companies can invest in reskilling and upskilling programs to equip their accounting teams with the skills needed to thrive in this new environment. Plus, given the ongoing accounting talent shortage, under-resourced teams can rely on AI to tackle less desirable work.

As accounting and finance teams prepare to use AI-powered technologies, it helps to explore examples of how the process will continue to require human involvement.

AI in Action: Improving Invoice Processing and Cost Savings

Scenario: A corporate finance team is drowning in a sea of paper invoices. Processing them manually is slow, error-prone, and consumes valuable time. To address this challenge, they might decide to leverage a combination of AI tools.

Step 1: Enter the invoices (OCR)

- The Tool: The finance team implements an OCR software.

- The Process: Employees scan a batch of invoices. The OCR software automatically extracts key data like vendor name, invoice amount, date, and line items from the scanned images.

- Human Involvement: A finance professional reviews the extracted data for accuracy. Minor corrections might be needed for messy handwriting or unclear scans.

Step 2: Learning from the data (ML)

- The Tool: The finance team uses a machine learning platform specifically designed for invoice processing.

- The Process: The extracted invoice data is fed into the ML model. Over time, the model learns to categorize expenses, identify duplicate invoices, and even flag potential fraudulent activity based on historical data and spending patterns.

- Human Involvement: The finance team monitors the ML model’s performance and provides feedback for continuous improvement. They might also set specific parameters for the model, such as thresholds for triggering fraud alerts.

Step 3: Gaining insights and taking action (AI outputs and human analysis)

- The Tool: The ML model generates reports and insights based on the processed invoices.

- The Outputs: These reports might highlight areas of high spending, identify frequently used vendors, or suggest opportunities for negotiation. The model might also flag invoices for further investigation due to anomalies.

- Human Involvement: Finance professionals analyze the reports and take action. They might use the insights to negotiate better rates with vendors, identify areas to cut unnecessary spending, or investigate potential fraudulent activity flagged by the model.

Step 4: Reporting with a twist (GenAI and LLMs)

- The Tools: While some generative AI technologies are still rapidly evolving, GenAI could be used to create different versions of financial reports tailored for specific audiences (e.g., a more detailed report for management and a simpler one for the board).

- The Process: Financial data and insights from the ML model could be used as inputs for GenAI to create customized reports. Large Language Models (LLMs) could also be used to generate clear and concise explanations of complex financial data within the reports.

- Human Involvement: Finance professionals would still oversee the report generation process and ensure the accuracy and clarity of the information presented.

This example showcases how AI tools can streamline workflows, improve accuracy, and generate valuable insights for corporate accounting and finance professionals. While human oversight remains crucial, AI can empower finance teams to be more efficient and strategic.

The Road Ahead: Embracing AI to Elevate Your Accounting & Finance Function

The adoption of AI in accounting and finance is no longer a question of “if” but “when.” By embracing AI and overcoming common objections, accounting and finance teams can unlock a new era of efficiency, accuracy, and strategic decision-making.