Flying Solo: Tax Advantages of Establishing a Single-Owner Business

Founding a business doesn’t necessarily require sharing ownership. In fact, businesses with a single-owner structure can meet an organization’s expansion goals while also providing tax benefits. Learn more in this tax overview of US disregarded entities.

When forming a new business entity, many choose to establish a limited liability company (LLC) or corporation to separate their personal and business liabilities. Another common form of business entity is disregarded entity (DRE), which is an entity that is not taxed separately for US federal and state income tax purposes. A single-owner or single-member LLC, partnership, or corporation can be treated as a DRE for tax purposes.

A DRE owner is generally not subject to entity-level US federal income tax, but instead, items of income, loss, gain, and deductions are reported on the owner’s tax return.

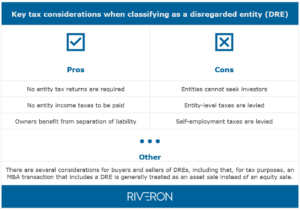

For business leaders considering establishing a DRE, it’s important to look at the pros and cons, including possible tax implications, along with considerations for likely strategies for company growth —such as an eventual sale through an M&A transaction.

DRE classification and tax treatment

DREs are commonly single-owner LLCs (they can also be individuals, corporations, subsidiaries, or partnerships) that have not affirmatively elected to be treated as a corporation or an eligible entity (generally, an LLC or a partnership) when filing IRS Form 8832 – Entity Classification Election. By default, a single-owner entity, such as an LLC, is treated as a DRE under tax law. A DRE owner is generally not subject to entity-level US federal income tax, but instead, items of income, loss, gain, and deductions are reported on the owner’s tax return. Along with the items of income and deductions, all assets and liabilities of the DRE belong to the single owner. If the owner is an individual, the income and expenses of the company will be reported as a sole proprietorship on IRS Form 1040 Schedule C. If the owner is a corporation, all income and expense items are reported on IRS Form 1120 for C-corporations and IRS Form 1120-S for S-corporations.

Most US states and localities recognize the federal treatment of DREs; however, some states may not recognize the federal treatment or may apply an entity-level tax. In addition, non-US countries may or may not have similar rules that allow for the tax treatment of a DRE.

The pros and cons of DRE classification

Being classified as a DRE can have advantages and disadvantages. The advantages are as follows:

- No entity tax returns are required. As mentioned above, the entity itself does not file a separate income tax return. The single owner or parent company is taxed and responsible for filing income tax returns. This will save the business time and money on compliance.

- No entity income taxes to be paid. The entity is treated as a flow-through entity, meaning the income and expense items flow through to the owner and the entity itself is not subject to income tax, avoiding the double taxes that are levied on C-corporations.

- Owners benefit from separation of liability. As an LLC, the company has separate liability from its owner, so the company’s assets are protected from legal claims against the owner’s property. If the company is sued, the owner’s personal assets may be at risk.

Some of the disadvantages of being classified as a DRE for tax purposes are:

- Entities cannot seek investors. DREs can only have one owner; therefore, the company cannot take on additional investors. This makes it difficult for a DRE to raise capital without becoming a different type of entity, such as a partnership.

- Entity-level taxes are levied. Certain states require LLCs to pay entity-level taxes, for example, franchise, gross receipts or excise taxes. In addition, DREs are still subject to non-income taxes such as sales and use taxes, property taxes, and payroll taxes.

- Self-employment taxes are levied. Since the owner of a DRE is considered self-employed, they’re responsible for paying self-employment taxes (i.e., Social Security and Medicare taxes) on the entity’s income. If a DRE has employees, the owner is responsible for withholding and remitting payroll taxes (i.e., federal income tax, Social Security tax, and Medicare tax) on behalf of the employees. The owner is also responsible for paying the employer portion of these taxes.

Tax implications for M&A of single-owner entities

When it comes to mergers and acquisitions (M&A), there are a variety of factors that need to be considered regarding a potential transaction. One area that must be explored is the tax implications of DREs for both the buyer and seller. A transaction that includes DRE for tax purposes is generally treated as an asset sale instead of an equity sale.

In an asset acquisition, the tax basis of the purchased assets may be adjusted, or “stepped-up,” to fair market value at amounts to be jointly agreed upon between the buyer and the seller, based upon the total consideration paid. In addition, a buyer generally will not retain the DRE’s historic US federal or state income tax liabilities, however, they would be a successor to the US state and local non-income tax liabilities, including (but not limited to) franchise tax, sales and use taxes, property taxes, state employment and payroll taxes, and unclaimed property liabilities.

When a DRE is acquired in an asset sale, the entity’s tangible assets such as equipment and inventory, as well as intangible assets, such as patents or trademarks are transferred or sold to the buyer. The sale of these assets can trigger tax implications, such as ordinary income, depreciation recapture, capital gains and losses, and tax-basis adjustments to the sellers.

Typically, buyers prefer asset sales, and sellers prefer equity sales. With an asset sale, the seller retains legal ownership of the company along with any historical income tax liabilities and long-term debt obligations. Buyers do not inherit the company’s historic liabilities. Further, buyers are able to step up the basis of assets, creating tax deductions for depreciation and amortization. In asset sales, buyers often make sellers whole through an increase in purchase price.

Disregarded entities can create unique tax implications in M&A. When acquiring a company, it’s important to consider the advantages and disadvantages of being classified as a DRE, the tax treatment of the entity and transaction, the transfer of assets versus a stock purchase, state and local tax implications, and future tax implications. By carefully analyzing these factors, buyers can ensure that they’re making an informed decision and minimizing their tax liabilities.

The way ahead

If you are an individual or part of a corporation looking to establish a single-owner business entity, you’ll want to carefully consider the type of business and its goals. For example, a business that may require outside investments for future operations would most likely benefit from a multiple-ownership structure. As always, it’s recommended to consult with a tax professional to fully understand the options for forming a new business entity or acquiring an existing one. Above all, CFOs want to elevate their impact by making informed decisions that balance organizational growth and financial prudence.