Bursting the Corporate Debt Bubble: Accounting for Debt Modifications

Over the last decade, the United States has seen a nearly 50 percent surge in corporate debt, bringing its outstanding balance to almost $10 trillion. Now, with the economic uncertainty associated with the coronavirus pandemic and the lowering of interest rates, corporate debt levels are only going to rise and the corporate debt bubble may burst sooner than initially expected.

Whether due to scheduled debt maturities, accelerated refinancings, or debt defaults, especially in light of the coronavirus pandemic, a significant number of companies, either by choice or forced by lenders, will be modifying their outstanding debt by restructuring its terms or by exchanging one debt instrument for another. ASC 470, Debt, provides the authoritative guidance on accounting and reporting for debt modifications, including troubled debt restructurings and debt extinguishments.

Here are three key steps companies can take to apply this guidance and account for debt modifications.

Troubled debt restructuring

The first step in accounting for any debt modification is to determine whether the modification represents a troubled debt restructuring (TDR). To qualify as a TDR, the debtor must be experiencing financial difficulties and the lender must have granted a concession to the borrower.

Financial difficulties may include defaulting on current debt, declaring bankruptcy, delisting securities, projecting insufficient cash flows to satisfy debt obligations, and being unable to obtain funds from sources other than existing creditors for similar terms for a nontroubled debtor.

A concession has been granted when the effective borrowing rate of the new debt is less than the effective borrowing rate on the original debt immediately prior to the restructuring. Typically, a TDR involves one or more of the following:

- Transfer of receivables and other assets to fully or partially satisfy debt

- Issuance of equity interests to the creditor to fully or partially satisfy debt

- Modification of debt terms such as a reduction of accrued interest and principal amount due, or extension of maturity date

Fully settling a debt obligation by transferring assets or equity interests has a similar effect on an entity’s financial statements—a gain is recognized for the excess of the carrying amount of the debt over the fair value of the assets or equity interest transferred. In the case of an asset transfer, companies must also recognize a gain or loss for the difference between the carrying amount of the assets and their fair value. Legal fees and other direct costs incurred by the debtor in an asset transfer reduce the gain or are included in expense during the period (if no gain is recognized), whereas, with the transfer of equity interest, those same costs reduce the fair value amount recorded for that equity interest.

Solely modifying the terms of debt in a TDR should be accounted for prospectively, with the carrying amount of the debt remaining unchanged, unless the undiscounted future cash payments of the specified new terms are less than the carrying amount. In this case, a gain would be recognized for the difference and the carrying amount would be reduced by that same amount. Future cash payments reduce the payable, and no interest expense is recognized. Similar to asset transfers, legal fees and other direct costs reduce the gain or are included in expense if no gain is recognized. When the undiscounted future cash payments of the specified new terms are more than the carrying amount, no gain is recorded and a new effective interest rate is established based on the carrying value of the original debt and the revised future cash flows. In this instance, fees paid to the lender are capitalized and amortized over the terms of the new debt. Other third-party costs are expensed.

A partial settlement of debt is accounted for in the same manner as above, with a gain only being recognized if the remaining carrying amount exceeds the undiscounted future cash payments specified by the terms of the debt remaining unsettled after the restructuring.

Furthermore, a TDR with equity interest holders or related parties may be accounted for as a capital transaction.

Other modifications and extinguishment of debt

When a debt modification does not qualify as a TDR, the next step is to determine if the modification qualifies as a debt extinguishment. An extinguishment of debt occurs when the terms of the new debt and original instrument are substantially different, which ASC 470 defines as at least a 10 percent difference in the present value of the future cash payments for the new and original debt instruments. The 10 percent test should consider fees paid to the lender, the existence of variable interest rate features, call or put options, and whether the debt has been exchanged or modified more than once in a twelve-month period.

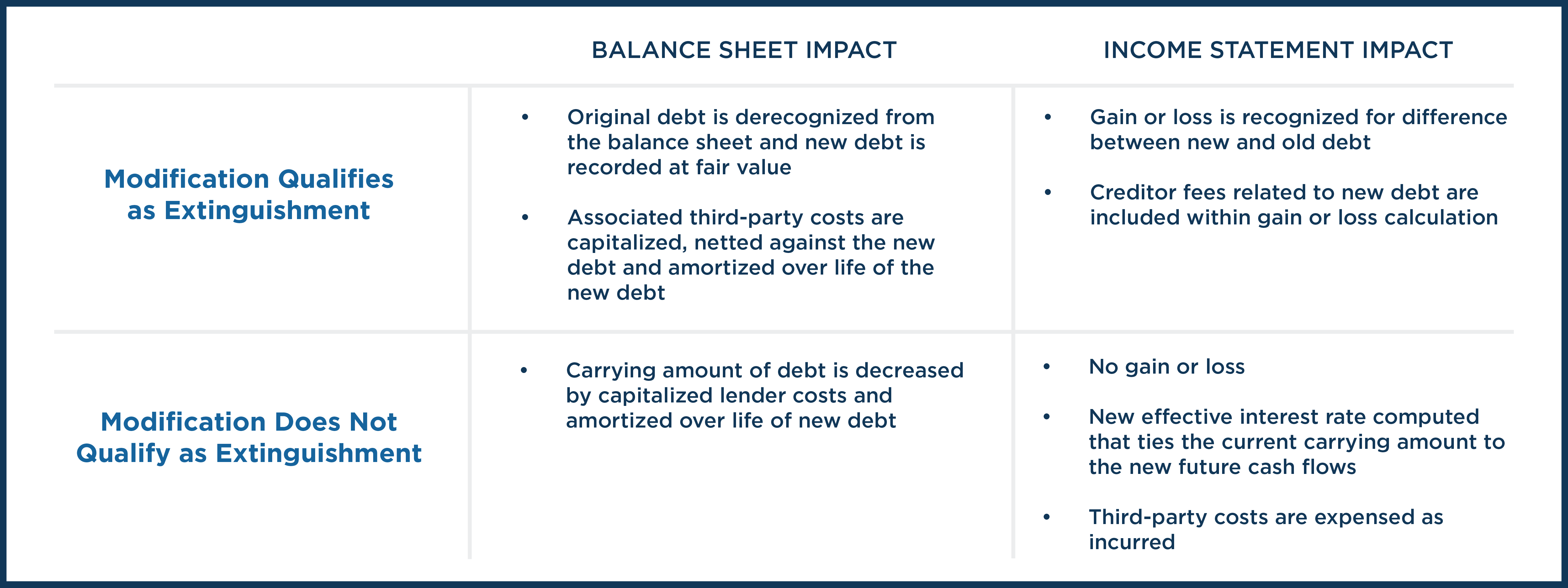

Balance sheet and income statement impact of debt extinguishment vs. debt modification.

Balance sheet and income statement impact of debt extinguishment vs. debt modification.

Lines of credit and revolving debt arrangements

When restructuring a line of credit or revolving debt arrangement, the difference in borrowing capacity (the product of the remaining term and maximum available credit) between the new and old debt is the key factor in determining the proper accounting treatment.

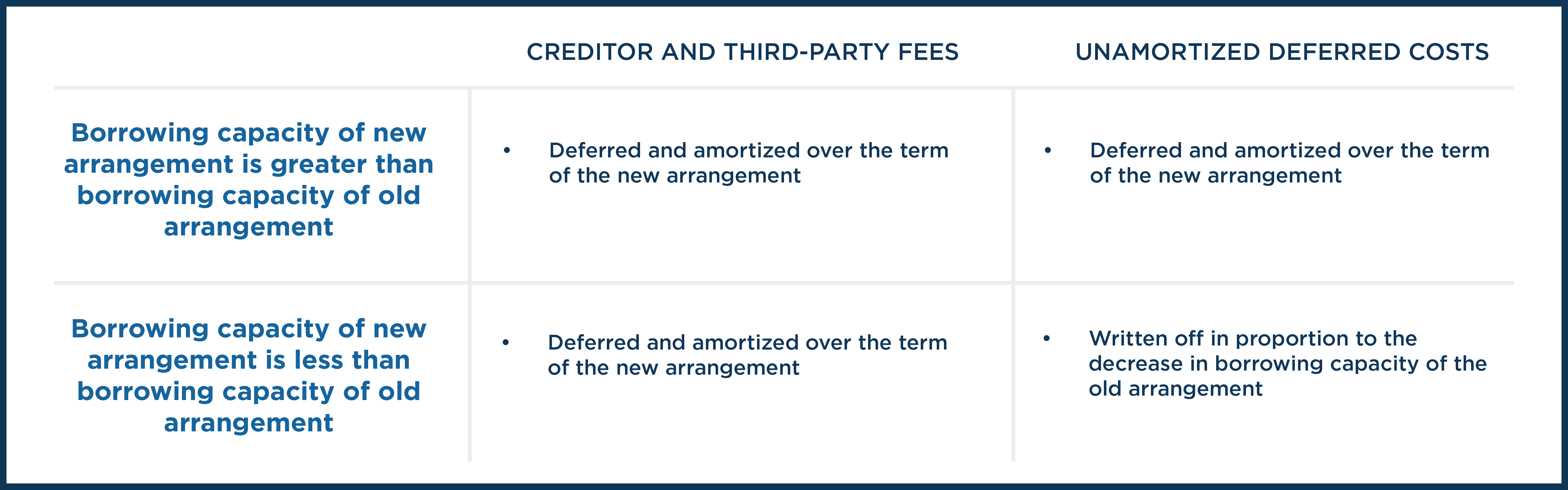

Accounting for lender and third-party fees, and unamortized deferred costs from the original debt.

Accounting for lender and third-party fees, and unamortized deferred costs from the original debt.

For arrangements consisting of multiple lenders (e.g., syndicated revolver), the analysis is performed on a lender-by-lender basis.

Additional financial reporting requirements

As with all significant transactions, US GAAP requires companies to tell their story through financial statement disclosures. Information entities must disclose includes the terms of the new debt; whether the old debt was extinguished; and any gains or losses recognized.

Many remain concerned about the unprecedented rise in US debt. As corporate debts become restructured, those tasked with accounting and financial reporting must proactively consider the accounting complexities and nuances related to debt modifications in order to satisfy reporting requirements.