How Key Financial Ratios and Metrics Are Impacted by the New Lease Standard

The core principle of the new lease accounting standard (ASC 842) is that a lessee will recognize the assets and associated liabilities that arise from all leases. This represents a significant shift from legacy guidance, specifically due to the inclusion of right of use assets and lease liabilities for all operating leases on the balance sheet. This increase in assets and liabilities impacts a number of key financial ratios and metrics. As an entity’s financial statements and its corresponding ratios are a key indicator of financial health and are relied on by lenders and reviewed by potential investors, management must understand the impacts from adopting the new lease standard and educate users of the financial statements and key stakeholders before the changes are reflected in the financial statements. These changes may also result in investors and lenders reconsidering which financial metrics they use in making investment or funding decisions.

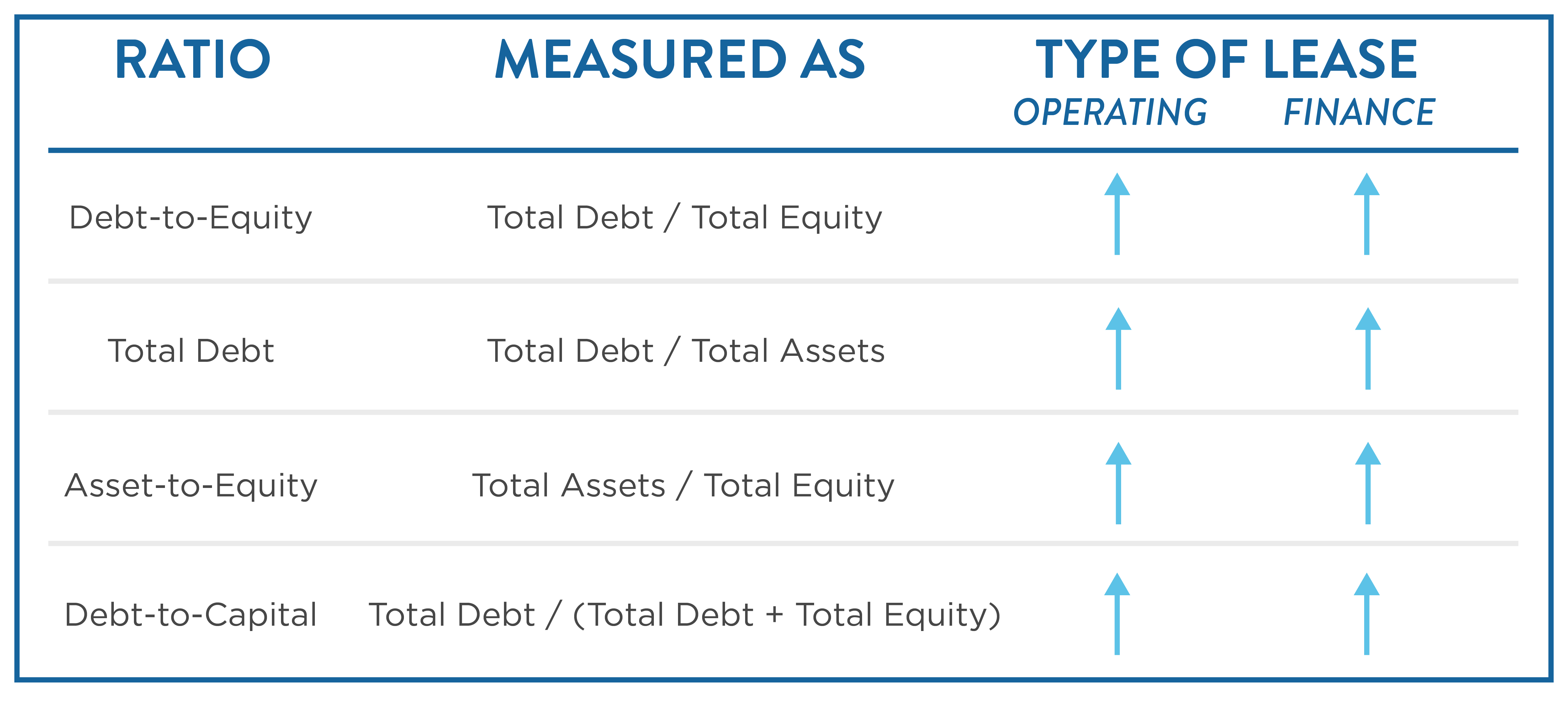

Leverage Ratios

The financial metric most significantly impacted by the new lease standard will likely be leverage ratios, which are used to determine the relative level of debt that a business has incurred. An increase in total debt (recognition of operating lease liabilities) and total assets (recognition of the right of use assets) are the main contributors to the change in these ratios. Credit facility agreements, commercial loan agreements, and corporate guarantees often contain financial covenants that include key leverage ratios. Management must understand and monitor the impact to such ratios and covenants, so that the entity is less likely to be caught in the stringent and lengthy process of admitting and curing a default

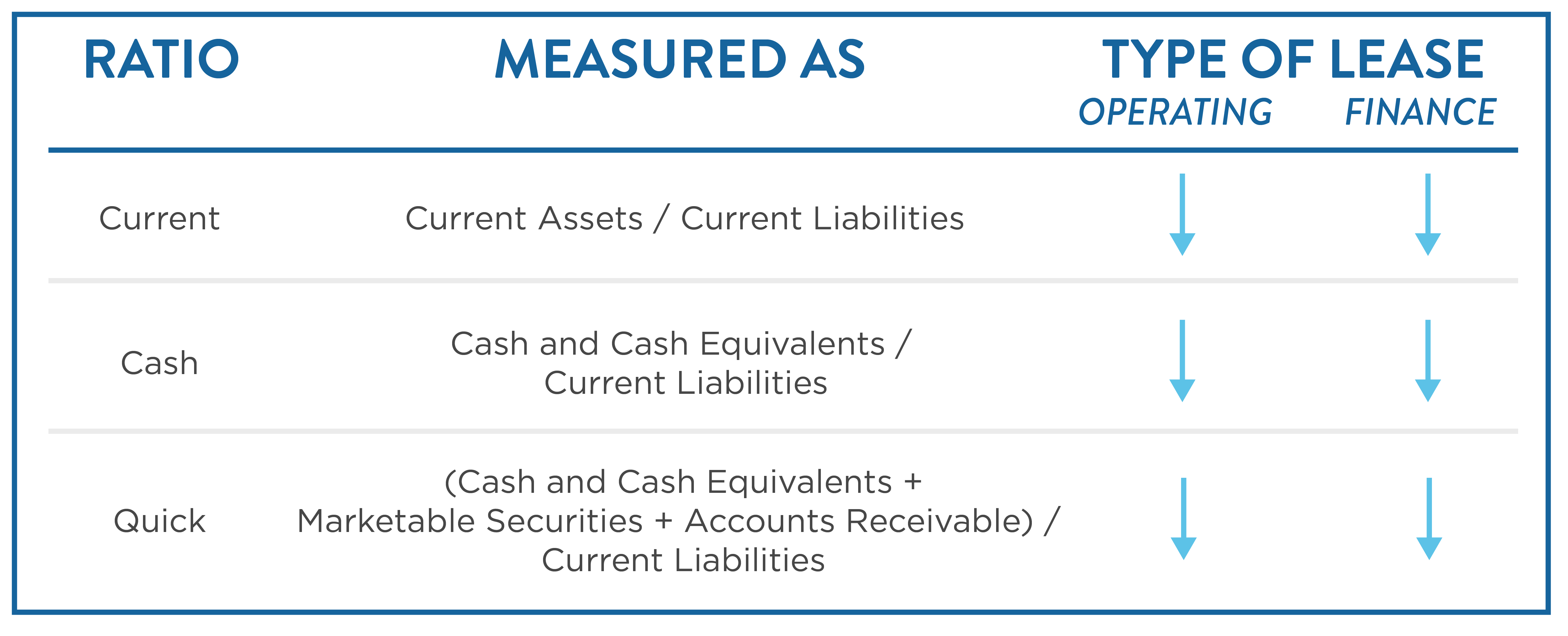

Liquidity ratios

Liquidity ratios, metrics used to evaluate the relative ability of a company to pay off its short- term obligations, will also be significantly impacted. An increase in current liabilities (the denominator) due to recognizing the operating lease liabilities is the primary driver for the expected decrease in these key ratios. Liquidity ratios are often used by prospective lenders and creditors in their assessment of whether to extend credit to the company and is therefore vital for management to monitor the impact by the new lease standard on these ratios.

Profitability, EPS, and cash flow ratios

Profitability, EPS, and cash flow ratios are key metrics of interest to investors and even though the adoption of ASC 842 does not impact certain profitability metrics such as revenue, operating income, EBIT, and net income, management can utilize strategic lease structuring opportunities to achieve desired outcomes by fully understanding and appreciating the impact of the new lease standard on these metrics. For example, structuring a lease arrangement to achieve finance lease classification results in higher operating income and earnings before interest and taxes as a result of interest expense on such leases being excluded from the calculation of operating income.

The adoption of ASC 842 also impacts two key cash flow ratios that are often of high interest to investors and lenders: the debt coverage ratio and the cash return on assets ratio. The debt coverage ratio will decrease as a result of the increase in total debt (the denominator in the calculation of debt coverage ratio) due to the recognition of operating lease liabilities. The recognition of operating lease right of use assets leads to an increase in total assets (the denominator in the calculation of the cash return on assets ratio) and, accordingly, will cause a decrease to the cash return on assets ratio.

Companies should be aware that changes or corrections of errors that result in a lease classification change will impact profitability and cash flows. For example, a change in lease classification will result in a change to cash flow from operations since a portion of any finance lease payment represents a repayment of the lease liability and should accordingly be classified as a financing cash outflow as opposed to an operating cash outflow.

Summary

ASC 842 represents one of the most impactful changes to accounting and financial reporting changes in decades. The change affects key ratios and metrics that entities typically report to investors, lenders, and other key stakeholders. While ASC 842 will not go into effect until January 1, 2021 for private companies that have a calendar year-end, companies should prepare early for the change to the new standard.